-

Are aeroplanes just ships of the sky?

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk object finance0 Votes8 Posts15 Views -

Qualitative rating factors

Watching Ignoring Scheduled Pinned Locked Moved Internal Ratings Based (IRB) Discussion qualitative factors0 Votes8 Posts1k Views -

Internal Risk Rating Development Questions

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk cre c&i dod segmentation0 Votes7 Posts8 Views -

Quantifying MoC A for a change in the definition of default which has no impact

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk0 Votes6 Posts38 Views -

PD and LGD Masterscales: MRM Classification

Watching Ignoring Scheduled Pinned Locked Moved Model Risk Management mrm masterscales pd calibration lgd calibration what is a model0 Votes6 Posts11 Views -

30th of June Oliver Wyman Wholesale Roundtable

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk0 Votes6 Posts60 Views -

Innovative way to run company Committees

Watching Ignoring Scheduled Pinned Locked Moved Risk Culture0 Votes5 Posts995 Views -

Compliance in risk taxonomy

Watching Ignoring Scheduled Pinned Locked Moved Regulatory Compliance compliance risk risk taxonomy risk identification0 Votes5 Posts13 Views -

9th of October Oliver Wyman MRM/AI Roundtable Discussion Group

Watching Ignoring Scheduled Pinned Locked Moved Model Risk Management0 Votes5 Posts38 Views -

GenAI validations for banking MRM

Watching Ignoring Scheduled Pinned Locked Moved Model Risk Management mrm model risk model validation genai ai0 Votes5 Posts4 Views -

IRB approval level (Group vs Country)

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk irb credit risk group vs local legal entity0 Votes5 Posts13 Views -

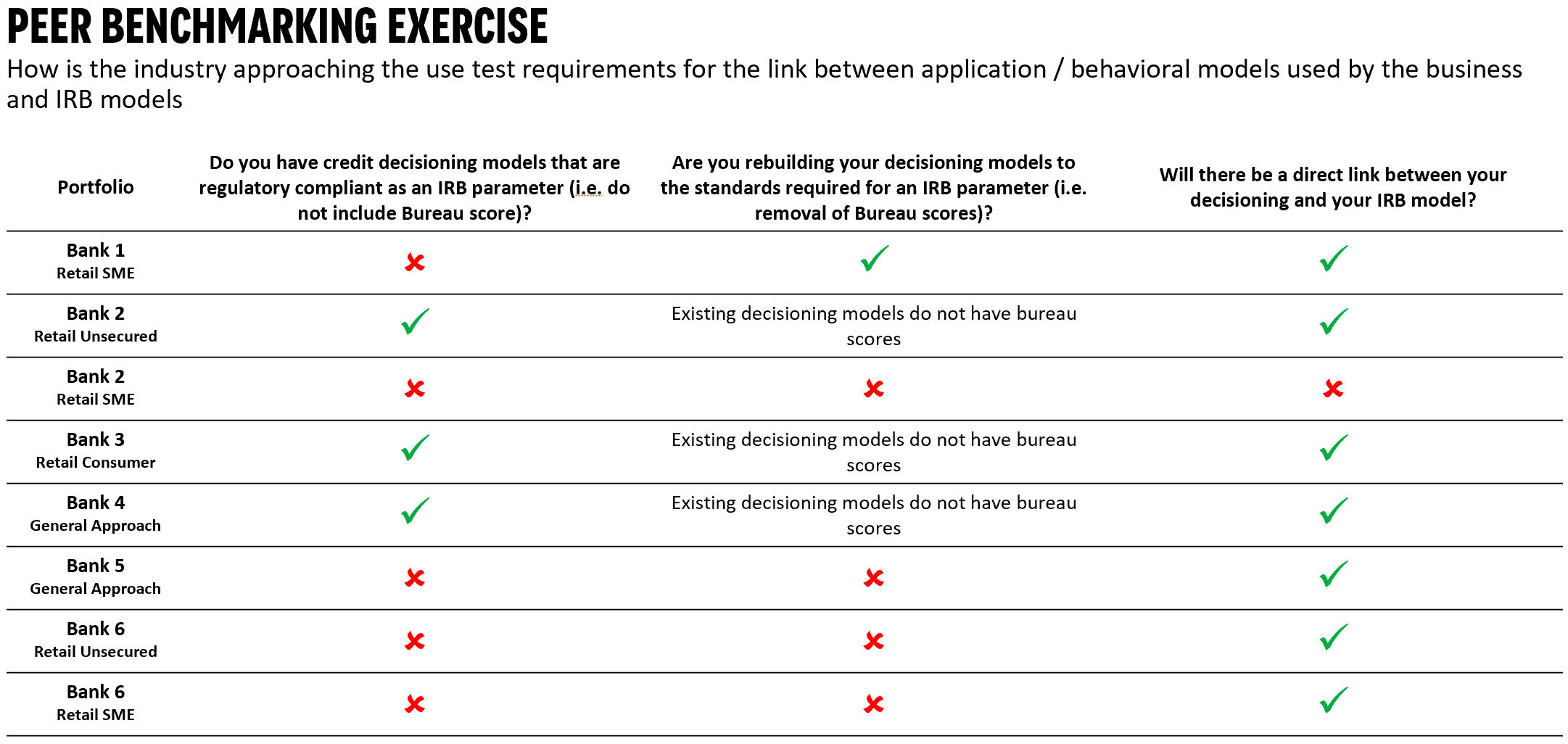

Use test requirement benchmarking survey

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk 1

0 Votes4 Posts15 Views

1

0 Votes4 Posts15 Views -

How deeply to evaluate Limited Partners while rating subscription finance exposures

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk private credit subscription finance specialised lending0 Votes4 Posts4 Views -

Benchmarks for predictive power of retail underwriting models

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk0 Votes4 Posts34 Views -

Social listening AI to identify potential scams

Watching Ignoring Scheduled Pinned Locked Moved Regulatory Compliance social media risk signals fraud risk0 Votes4 Posts14 Views -

Should Model Risk /Validation care about cost?

Watching Ignoring Scheduled Pinned Locked Moved Model Risk Management0 Votes3 Posts25 Views -

FIRB scope for wholesale SME

Watching Ignoring Scheduled Pinned Locked Moved Internal Ratings Based (IRB) Discussion firb wholesale credit0 Votes3 Posts535 Views -

Obligations of board toward AI risk

Watching Ignoring Scheduled Pinned Locked Moved Risk Data and Analytics ai risk board accountability0 Votes3 Posts651 Views -

Use of group IRB models in EU subsidiary and representativeness

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk irb group models large corporate credit risk0 Votes3 Posts6 Views -

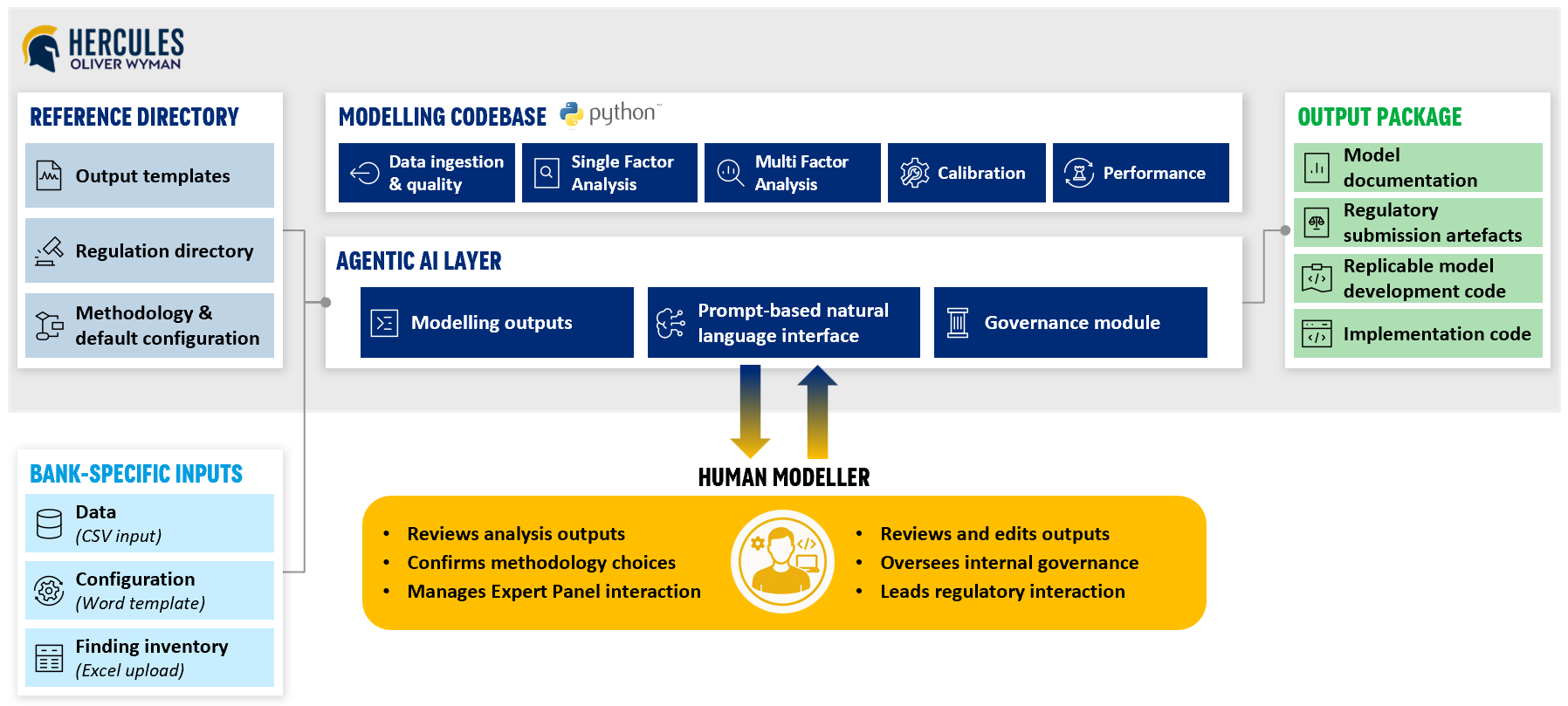

Credit risk modelling: Driving Efficiency with AI

Watching Ignoring Scheduled Pinned Locked Moved Credit Risk hercules ow credit risk modelling ai agentic ai 4

0 Votes3 Posts25 Views

4

0 Votes3 Posts25 Views