As announced as part of the government’s Financial Services Growth and Competitiveness Strategy, the Prudential Regulation Authority (PRA) has introduced a more responsive approach for receiving, reviewing, and approving Internal Ratings Based (IRB) model applications . This new approach is designed to enhance the model approval process for banks with existing internal models.

Key elements of the PRA’s updated approach include:

Enhanced Pre-Application Engagement: PRA will work more closely with firms before formal submissions to assess readiness and flag complex issues early.

Dedicated Submission Slots: Firms will have designated slots for application submission, increasing procedural clarity and predictability on both sides.

Accelerated Documentation Quality Checks: The PRA aims to complete thorough checks on application documentation within 4 weeks.

Defined Review Timelines: Complete submissions will undergo review within 6 months if no additional information is needed.

Final Decision Targets: PRA targets concluding decisions on applications within 18 months.

Implications for Banks

This transparent and disciplined approach is welcomed by firms. However, it makes banks’ committed model submission dates more important than ever. Firms need to be confident that they will be able to deliver the model in a certain month (with a foresight of a year in advance), having gone through a robust governance and validation process. They will also need to ensure all parts of the submission are complete and of good quality. Failure to deliver on time or to the expected standard will risk putting them ‘at the back of the queue’, resulting in more costly re-developments and potentially supervisory add-ons.

We see leading banks taking the opportunity to enhance their IRB model delivery and submission strategies.

Conduct a Comprehensive End-to-End Stock-Take of IRB Submissions

Across the board, we have observed the following best practices to fully review the current IRB model submission plans. This stock-take includes:

Evaluate the feasibility and readiness of each submission relative to the PRA’s timelines and quality expectations. This is done in the light of both previous supervisory feedback and modelling challenges, to come to an honest assessment of whether a model can be delivered in a certain month.

Integrate business and strategic priorities—focus should be placed on portfolios that align with the bank’s risk strategy and have the highest business impact.

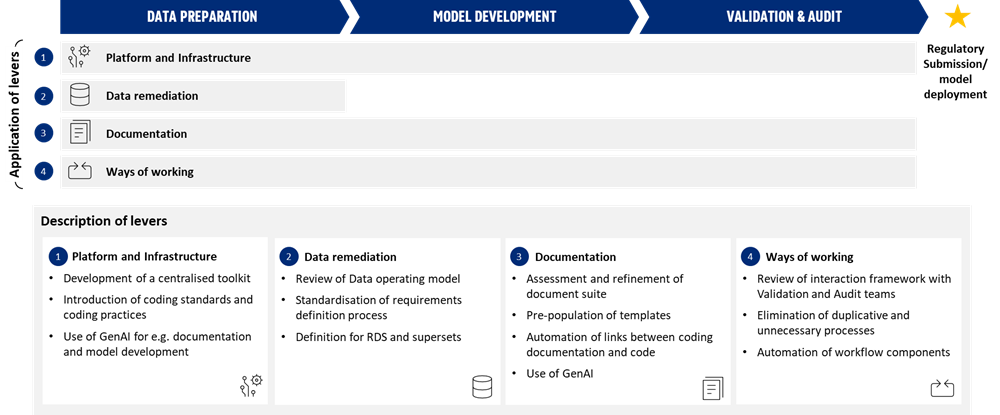

Evaluate levers to shorten delivery timelines – most banks now have elements of parallelization of different model development activities rather than a sequential ‘waterfall’ type approach

Incorporate implementation readiness: given the PRA's more certain and shortened review timelines, banks should rigorously assess their ability to implement approved models within the required timeframe. Implementation timelines should be a critical dimension in deciding which models are "ready" for submission, ensuring that operational systems and infrastructures are aligned to support timely deployment post-approval.

Enhance planning and regulatory engagement

Our experience shows that the following three pillars are critical to ensuring a smooth, timely, and successful approval:

Rigorous project management: the more formally and firmly committed timelines demand rigorous project management and discipline to meet deadlines. Late or rushed submissions significantly increase the risk of extensions and requests for additional information

Avoid pitfalls from weak or incomplete documentation: all components of the submission package and in particular model documentation need to be planned from the outset to avoid gaps or quality issues that can jeopardise the model review proceeding as planned by ‘stopping the clock’ and having to re-submit

Maximize the impact of pre-engagement meetings: the new pre-engagement meetings are an opportunity to present key elements of the model to the PRA end-to-end and provide specialists with the answers to key questions early on. In order to use this valuable time in the most impactful way, banks should prepare materials that directly address the PRA’s key areas of focus, including:

Quality and depth of data and historical information used

Key judgments and modelling assumptions

Evidence of senior management involvement and ownership

Thoroughness of internal model validation and challenge processes

By preparing high-quality, thoughtful presentations, banks can avoid surprises during the review phase.

How We Can Help

We recognise that the evolving supervisory approach poses new challenges and have worked with our clients to address these:

Ensuring high-quality, complete submissions that meet PRA expectations and pass documentation quality checks first time

Providing targeted project support to help banks meet the PRA’s accelerated regulatory timelines without sacrificing rigor

Assisting clients in strategically prioritizing IRB submissions to align with both regulatory readiness and broader business goals, maximizing impact and resource efficiency

By partnering closely with our clients on these fronts, we help them transform regulatory requirements into competitive advantages and successfully navigate this evolving regulatory landscape.