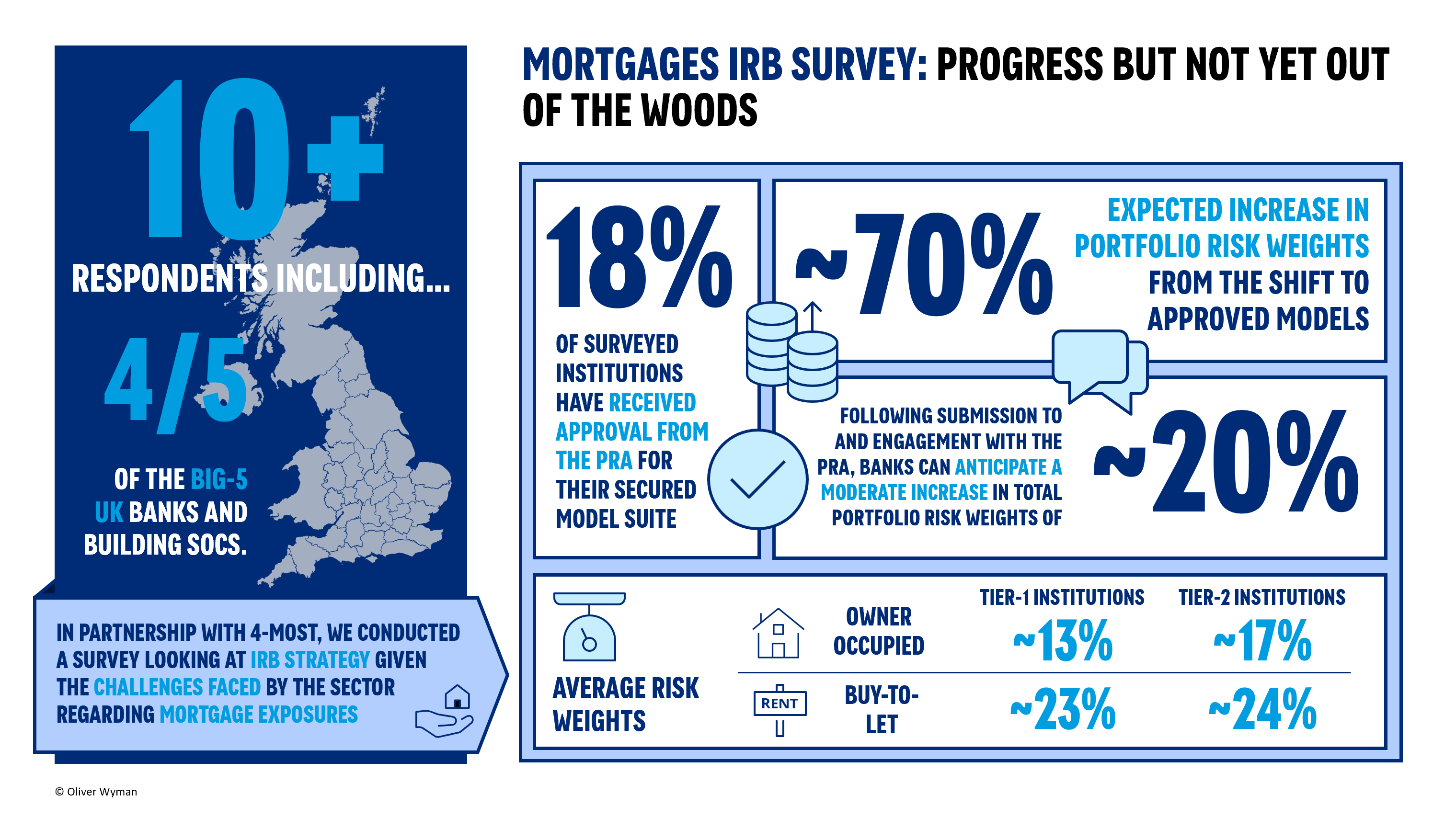

Internal Ratings Based (IRB) Discussion

Our dedicated space to discuss practicalities and technicalities of credit risk modelling using internal modelling approaches

10

Topics

24

Posts

Contact Oliver Wyman

Reach out to our team if you want to collaborate on recent developments in Risk.