Oliver Wyman Secured exposures IRB Survey

Pinned until 20/06/2025, 16:00

Internal Ratings Based (IRB) Discussion

-

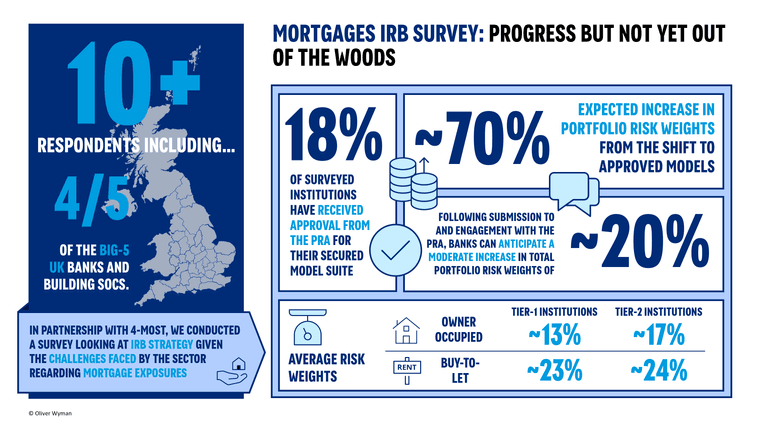

In the evolving financial and regulatory landscape, UK banks face critical challenges in enhancing their Internal Ratings-Based (IRB) model suites, particularly for Mortgage exposures

A survey was conducted in Q2 2025 by an Oliver Wyman-4most partnership to gather insights on IRB strategies across UK institutions with significant mortgage exposures

Topics covered in this survey include:-

Status of IRB Model Suite: Approval status of their IRB models and any specific challenges raised by the PRA

-

Quantum of change between model suites: Insights into changes between PRA-approved and incumbent model suites

-

Distribution of Risk Weights by DTV: Analysis of risk weight distribution in their secured portfolio

Reach out for more insight

-

-

A abbas.razaq pinned this topic