Tariffs - Navigating their impact on credit portfolios

-

The current environment exhibits a unique configuration of risks that traditional credit analytics do not capture – such as escalating tariffs under the Trump administration, rising protectionism, global realignment of supply chains, heightened market volatility, and a spike in geopolitical uncertainty. For such a heady mix of risks, scenario analysis will play a crucial role over the next months in navigating a rapidly evolving economic environment, acting as both a key driver of credit actions through better visibility on mostly impacted industries/ clients, allowing for better credit decisions and mitigating action, as well as a key response tool to increased supervisory scrutiny. And beyond what happens with tariffs in the coming weeks, banks will need analytics such as this to weather the expected volatility of the next 18-24 months

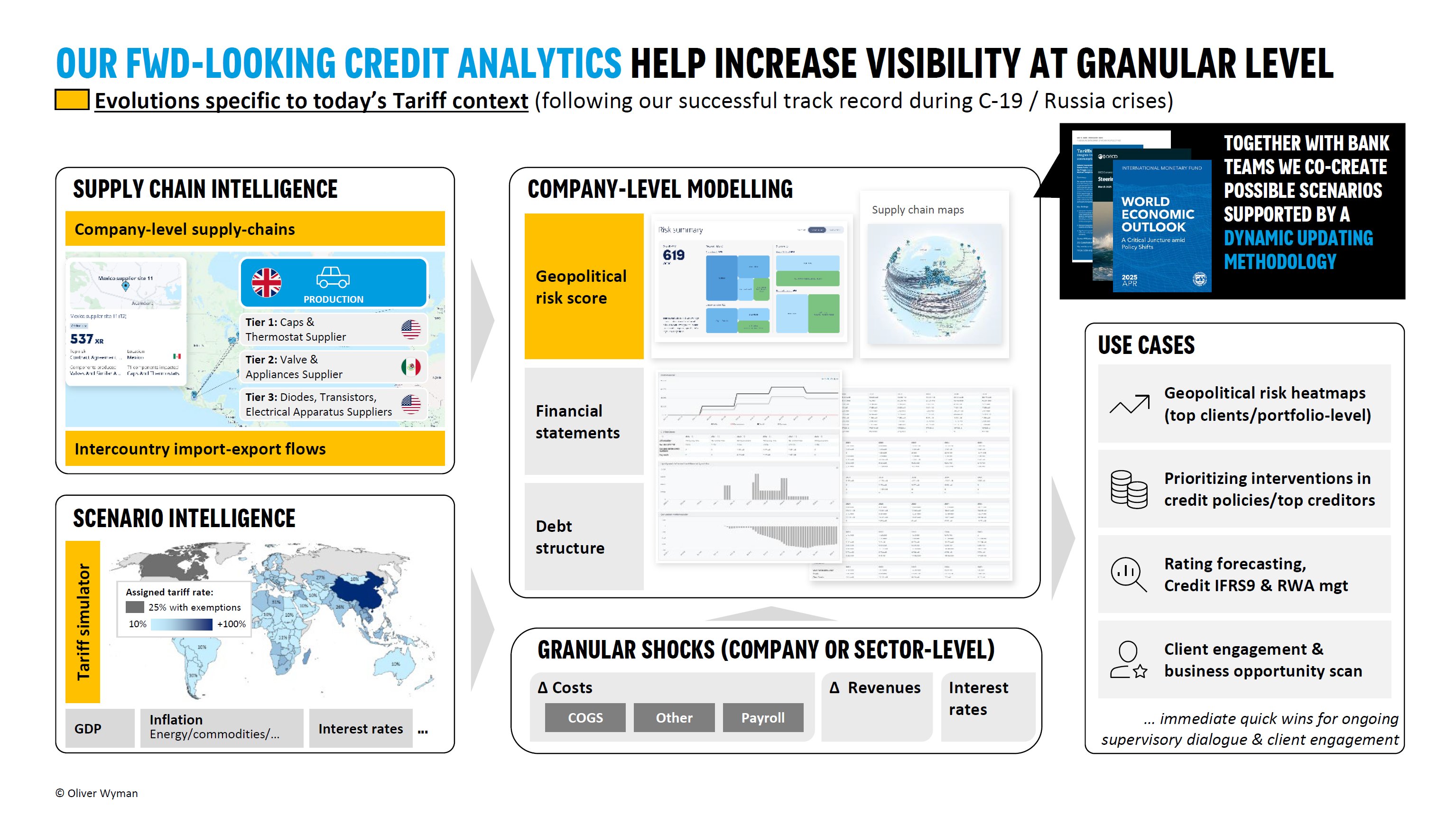

We have evolved our forward-looking credit analytics (successfully road-tested during C-19 and Russia crises) to the new environment, incorporating supply chain as a key driver of impact propagation to increase visibility on granular client- and portfolio-level dynamics under fast-evolving macro-scenarios

-

We co-create with your teams possible tariff scenario narratives and parameters, supported by a dynamic updating methodology. In a context of high uncertainty, we define scenarios ranging from contained to high impact

-

Portfolio heatmaps linked to export and/or import dependency, help us tier the portfolio and prioritize deep-dives into key vulnerabilities, together with broader macro sensitivity analyses

-

For most affected portfolio clusters, we map granular supply chains to understand direct and indirect tariff exposure at individual company-level, modeling key upstream and downstream impacts at the company-level on: (i) production cost, (ii) sales price and profit margin, and (iii) sales volumes. For less impacted portfolios, company-level projections are derived from granular sectorial impacts to ensure a holistic portfolio coverage

-

Above outputs can be leveraged across a wide range of use cases, incl. (i) rating / RWA / provisions forecasting, (ii) prioritization of adjustments to credit policies, (iii) credit decisioning challenge and (iv) business opportunity scan - identification of trade-related business opportunities

-

We can leverage our successful track record during C-19 and Russia crises to demonstrate how our dashboards are seamlessly embedded into your systems

We can offer alternative support models depending on the use cases prioritized and level of methodology/technology sophistication of our deliverable

-

An initial heatmapping/pilot phase can help accelerate a first scan of key portfolio vulnerabilities, framing how the approach fits within existing capabilities and performing a pilot test with a subset of clients to showcase our capabilities

-

This can be followed by a Delphi framework roll-out whereby we deploy our analytical tools, parametrize it to your portfolio and together with you define evaluation results and ensure a proper transfer of knowledge

-

We successfully supported 30+ institutions develop forward-looking credit capabilities, initially triggered by C-19 and Russia crises and then embedded in day to credit decisioning. We also have recent experience specific to the Tariffs environment and are happy to put you in touch with clients to get references

Get in touch to hear our latest thinking

-

-

A abbas.razaq referenced this topic on