Oliver Wyman Tariff Tearsheet - 8th May

-

With deals starting to get done we plan to pivot the Tearsheet away from a curated news/report digest further towards more of our own analysis. Next Tuesday’s Tearsheet will be devoted entirely to the impact on banking.

Today's Tearsheet features insights on global interest rate divergence and tariff implications from Bloomberg, Reuters, BBC, WSJ, Signum Global Advisors, NPR and Oliver Wyman

-

Global central banks diverge in rates movements as tariff risks and uncertainty hamper US Fed: The Fed holds rates steady while others cut, highlighting economic impacts from tariffs (Bloomberg, Reuters, BBC, WSJ)

-

Trump 2.0: Trade - UK 'Exceptionalism': The UK benefits from a unique trade status, easing integration into frameworks like USMCA (Signum Global Advisors)

-

Companies are actually changing supply chains: Puma shifts sourcing from China to Southeast Asia, potentially raising U.S. prices (OW analysis, US News)

-

Almonds are going to be cheaper for Americans?! – We’re seeing economic theory around tariffs play out: California almond exports fall, highlighting economic theories that eventually lead to lower quantities and higher prices (OW analysis, San Francisco Chronicle, Food and Water Watch). Warning: you will see demand and supply curves

-

Trade war has much bigger negative impact on US than China (Apollo)

-

What “Made in China” actually means. If you wondered how the US decides how “Made in China”, or any other country, is determined, get ready to learn about a weird and convoluted process. And yes, blame the lawyers. (NPR Planet Money podcast)

Global central banks diverge in rates movements as tariff risks and uncertainty hamper US Fed

Bloomberg, Reuters, BBC, WSJ, 8th May 2025The Fed is reading all the same articles as you are. It’s looking at all the same data as you are. It’s reading trade talk tea leaves like you are. And it’s not any more certain about what’s going to unfold in the near term as you are.

Recent quotes from Fed Chair Jerome Powell:

-

“I think there’s a great deal of uncertainty about, for example, where tariff policies are going to settle out. And also when they do settle out, what will be the implications for the economy, for growth, and for employment. I think it’s too early to know that.”

-

“The tariff increases announced so far have been significantly larger than anticipated. All of these policies are still evolving, however, and their effects on the economy remain highly uncertain.”

-

“Again, to say it again, the — the timing, the scope, the scale, and the persistence of those effects are very, very uncertain. So it’s not at all clear what the appropriate response for monetary policy is at this time”

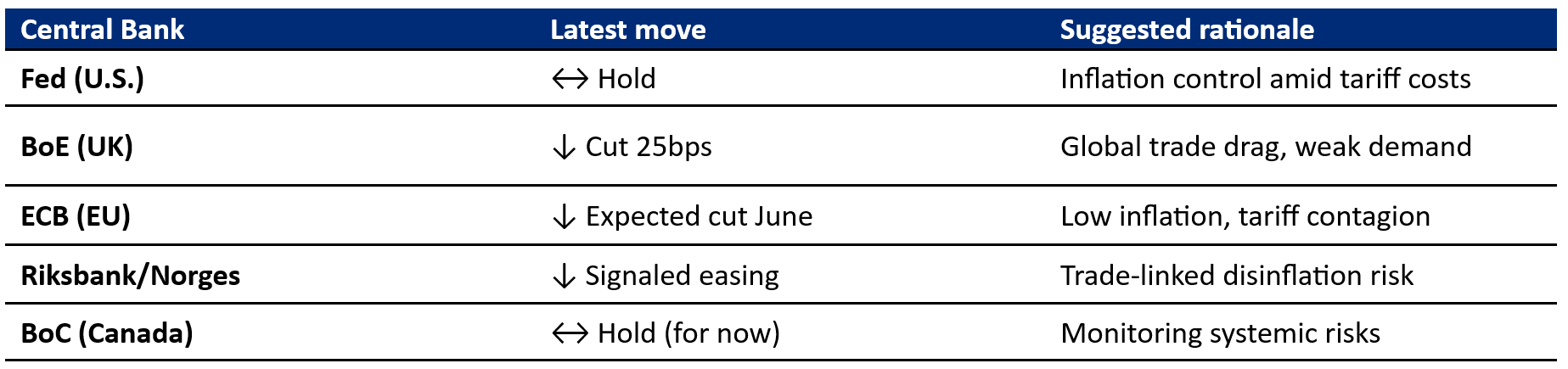

While the Federal Reserve has maintained its interest rates at 4.25%–4.5%, citing concerns over rising inflation and unemployment, other central banks have adopted more accommodative stances. For instance, the Bank of England reduced its key rate by 25 basis points to 4.25%, and both Sweden's Riksbank and Norway's Norges Bank signaled potential rate cuts, all aiming to mitigate the economic impact of global trade tensions. The European Central Bank is also preparing for another rate cut in June after a 25 basis point cut in April. These moves highlight a growing policy divergence: U.S. tariffs are stagflationary at home but only stagnationary [OW trademarked term -- you heard it here first] abroad. The former presents a monetary policy conundrum, the latter suggests an easing of interest rates.

U.S. Federal Reserve – Cautious amid stagflation risk

- Maintains rates at 4.25%–4.5% despite early signs of slowing growth.

- Fed Chair Jerome Powell emphasizes uncertainty from President Trump’s tariff regime, especially:

- Cost-push inflation from higher import prices

- Rising risk of stagflation (inflation + softening labor and output)

- Powell signals no near-term rate cut until inflation decelerates or job losses rise further.

Bank of England – Rate cut to cushion demand shock

- Cuts policy rate by 25bps to 4.25% (May 8), citing tariff-related trade drag.

- U.K. policymakers worry U.S. tariffs will slow global trade, hurting U.K. exports and confidence.

- UK inflation cooling gave BoE room to act — shows contrast with U.S. price dynamics.

Bank of Canada – Structural exposure highlighted

- BoC flags U.S. tariffs as a primary external threat in its 2025 Financial Stability Report:

- Loan delinquencies rising among export-reliant households and SMEs.

- Concerns over sector-wide downgrades in autos, logistics, and agriculture.

- Potential for credit rationing and knock-on effects in consumer lending and CRE.

- Canada isn’t easing yet, but domestic financial stress is mounting.

Possible implications of fragmented policy moves:

- Market volatility, hedging, and trading stress: Divergent global policy paths (Fed holds while others cut) cause:

- FX volatility (stronger USD → EM pressure, lower U.S. exporter competitiveness)

- Commodity price swings due to demand softening and tariff distortions.

- Asset managers may struggle with volatility hedging, especially in cross-asset portfolios tied to rates, trade, or currencies.

- Fragmented capital flows: Institutions might further reassess cross-border capital allocation and funding models.

- Emerging tail risks: Trade policy-driven credit tightening could catalyze a late-cycle downturn, especially if U.S. inflation remains stubborn.

Trump 2.0: Trade - UK 'Exceptionalism'

Signum Global Advisors – 8th May 2025The recent US-UK trade deal, under President Donald Trump's administration, highlights unique aspects of the UK’s position in international trade relations. While the US-UK trade deal is a milestone, its implications should be viewed with measured optimism, given the unique circumstances favoring the UK and potential challenges in broader trade negotiations.

Reasons for caution in terms of whether this is a positive indicator for the rest of the world:

-

UK's favorable position: The UK enjoys a special status in Trump's 'Fortress America' vision, which includes the US, Canada, Mexico, and the UK. This unique relationship has led to speculation about potential UK integration into the USMCA framework

-

Non-threatening exports: Unlike Japan, the UK's exports to the US, particularly in sensitive sectors like automobiles, do not pose a significant threat, facilitating smoother negotiations

-

Lack of recent precedents: The absence of recent successful trade negotiations between the UK and US allowed the UK to capitalize on 'low-hanging fruit', suggesting easier deal-making compared to countries with established trade negotiation histories

Broader implications:

- Not solely focused on the UK: While the UK deal is prominent, other countries like India also show positive signs for trade agreements

- Expectations of trade deal dynamics:

- Anticipated trade deals during the tariff reprieve period are likely to be:

- Slower in negotiation process

- Fewer in number than initially expected

- This slower pace may lead to more tariff reinstatements around July 8 than current consensus predicts

- Anticipated trade deals during the tariff reprieve period are likely to be:

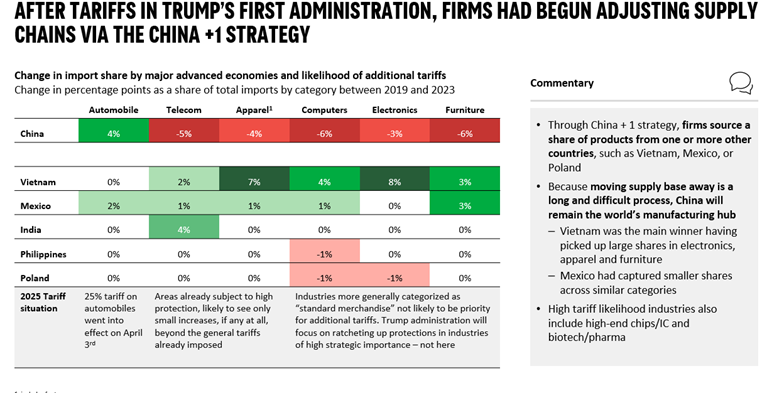

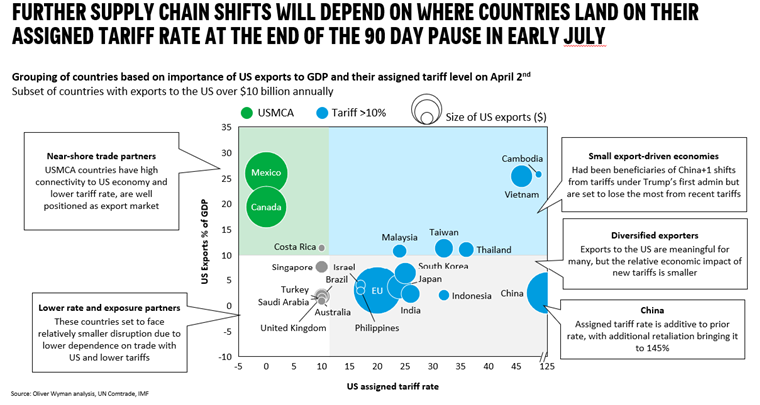

Companies are actually changing supply chains: Sports Brand Puma Adapts Supply Chain for China Tariffs Impact, Hints at US Price Hikes

Oliver Wyman analysis, US News, 8th May 2025Puma, a German sportswear brand, is adjusting its supply chain in response to tariffs affecting imports from China to the United States (aiming to mitigate risks associated with potential tariff reinstatements by the U.S. administration.) The company plans to potentially increase prices in the U.S. market

-

Supply chain adjustment: Puma has reduced the proportion of products shipped from China to the U.S. from 28% to 10%, shifting sourcing to Vietnam, Cambodia, and Indonesia

-

Potential price hikes: Puma is monitoring competitors' pricing strategies (notably that of Nike) before adjusting its own prices in the U.S. market, following cost increases due to tariffs

-

Inventory increase: Puma's inventories rose 21% as it delivered more products to the U.S. ahead of tariff implementation

[OW Analysis] A few possible learnings (and possible effects for the US financial services industry to consider) from this:

Tariffs act as a supply chain tax, not a demand boost

- Puma’s experience reflects the cost-side strain tariffs impose on global retailers.

- Companies shift sourcing—not production back to the U.S.—undermining reshoring goals.

- Consumers likely face higher retail prices, especially if competitors also hike.

Pre-tariff inventory stockpiling masks true demand

- The 21% inventory surge for Puma reflects front-loading, not organic growth.

- This front-loading may lead to Q2 margin pressure as discounts are used to clear stock amid weak U.S. wholesale demand.

U.S. tariffs are depressing global demand & forcing margin compression

- Retailers like Puma absorb input inflation to protect market share.

- Tariffs are indirectly reducing U.S. wholesale orders—echoing trends in agriculture and manufacturing where intermediate demand weakens.

Credit risk in consumer discretionary sector

- Retailers with global supply chains (e.g., apparel, electronics) may see profitability deteriorate.

- Banks with exposure to trade-financed inventory, working capital lines, or unsecured loans to retail brands should reassess default risk and covenant compliance

Capital markets headwinds

- Weak wholesale performance and margin pressure may deter equity raises or M&A activity.

- Puma’s challenges foreshadow broader investor caution in global retail equities.

ESG & labor scrutiny (maybe?)

- Shifting sourcing from China to Southeast Asia could trigger ESG scrutiny, particularly around labor practices and transparency in Vietnam/Cambodia factories.

- Lenders and insurers may be pressured to vet supply chain risks more closely.

In other words, as supply chains are reviewed, changed, and scrutinized, Sentrisk becomes ever more useful!

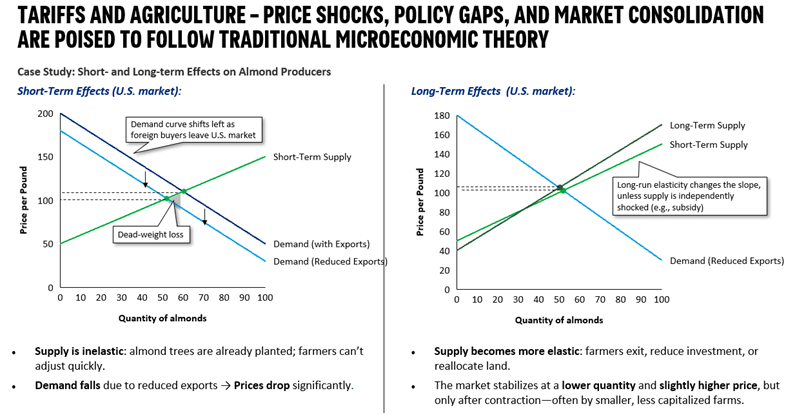

Almonds are going to be cheaper for Americans?! – We’re seeing economic theory around tariffs play out

Oliver Wyman analysis, San Francisco Chronicle, Food and Water Watch, 8th May 2025President Trump’s 2025 tariff policy—headlined by a 145% tariff on Chinese imports and a proposed 10% universal tariff—has reignited a global trade conflict with profound consequences for U.S. agriculture. Two case studies—the almond sector in California and broader commodity production in the Midwest—highlight how these policies are distorting markets, squeezing small producers, and accelerating structural consolidation.

-

Export demand collapse → domestic price suppression: Almond exports, 80% of California’s output, have plummeted due to Chinese and EU retaliation (i.e. China isn’t buying as many almonds from Americans, so demand has decreased! ). Prices are down sharply (due to this decreased demand), falling below breakeven for many growers ($2.00/lb vs. $1.75/lb cost). This has led to excess domestic supply and marginal grocery-store discounts—benefiting American consumers only modestly while producers absorb the loss

-

Historical structural inequities in farm relief: We can predict how this might play out in the long-term, using 2018 as an example. Tariff-related USDA bailout programs during the 2018–2019 trade war disproportionately favored large agribusinesses. The top 1% of recipients received over $180,000 on average; the bottom 80% received less than $5,000. Without reform, the same dynamic is expected in 2025.

-

Consolidation and exit of small producers: From 2017–2022, the number of small farms shrank, while operations earning over $5m nearly double. Tariff shocks, layered on top of volatile input prices, reinforce these structural shifts.

[OW Analysis] These patterns reflect broader macroeconomic theory around the effects of tariffs; using almond growers as a case study:

Broader application across industries

Export-oriented manufacturing (e.g., automobiles, machinery, semiconductors):

- Short-term: Retaliatory tariffs from trading partners reduce foreign demand. Inventory builds up. Prices fall. Firms cut margins or offer discounts

- Long-term: Small or regionally dependent manufacturers exit or get acquired. Capital flows to larger firms with diversified markets or vertical integration

- Outcome: Consolidation, job losses in high-exposure geographies, and long-term underinvestment in affected sectors

Technology and consumer electronics:

- Many U.S. firms operate with global supply chains. Tariffs on components raise input costs.

- In the short term, companies absorb costs or pass them to consumers, potentially reducing demand

- Long-term: Firms may offshore further to avoid tariffs, or lobby for exemptions—further eroding domestic supply chain sovereignty

- Smaller firms, without the ability to relocate or lobby, may fold or be acquired

Agriculture and commodities:

- As with almonds, many U.S. commodity sectors are deeply export-dependent.

- Short-term supply gluts cause price crashes.

- Long-term effect is rural economic decline, consolidation, and increased reliance on federal subsidies or corporate buyers

The almond tariff example is a clear, grounded instance of how trade policy, without parallel structural reform, can distort markets in both the short and long term. For financial services, this might have the following implications:

Sectoral Credit Risk and Asset Quality:

- Tariff shocks lead to increased bankruptcies and credit defaults—especially in agriculture, transport, and industrial manufacturing.

- Lenders with exposure to small and mid-size enterprises (SMEs) in trade-exposed sectors may face increased non-performing loans (NPLs).

- Insurance portfolios, especially those tied to crop yields, trade finance, and commercial real estate in agricultural regions, could see elevated claims or devaluation.

Market Volatility and Liquidity Disruptions:

- Trade policy uncertainty drives volatility in equities, commodities, and FX markets.

- Financial firms—particularly asset managers and trading desks—face increased hedging costs and margin volatility in affected sectors

- Capital markets issuance (e.g., IPOs or M&A activity in affected sectors) may slow due to valuation instability

Strategic Opportunity or Caution for PE and Banking:

- Private equity and investment banks may see distressed opportunities among mid-tier exporters or manufacturers squeezed by tariffs

- However, they’ll need to assess political risk premiums and the risk of permanent market exit from key global regions

- Large banks might benefit from increased trade finance advisory and structured hedging products, while regional banks could face concentrated losses

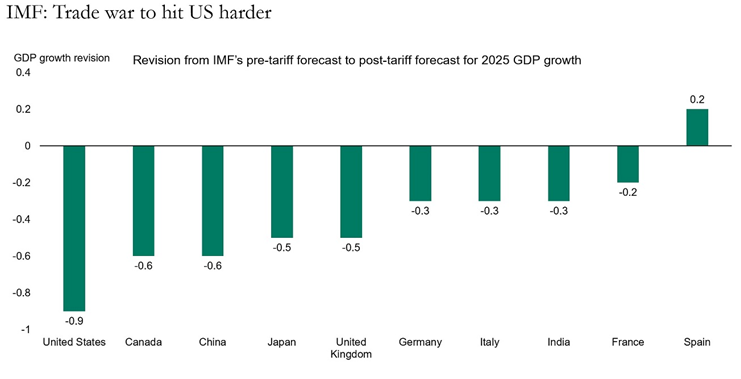

Trade war has much bigger negative impact on US than on China

Apollo, 8th May 2025The IMF just released their latest World Economic Outlook, and comparing their pre-tariff forecast from January with their forecast today shows that they expect the trade war to have a much bigger negative impact on the US economy than on other countries, including China, see chart below

What’s up with Spain?

What "Made in China" actually means

NPR Planet Money podcast, 8th May 2025Virtually every product brought into the United States must have a so-called "country of origin." Think of it as the official place it comes from. And this is the country that counts for calculating tariffs.

But what does it really mean when something is a "Product of China"? How much of it actually comes from China? And how do customs officials draw the line?

Here in the U.S., the rules are delightfully counterintuitive. A product's country of origin is not necessarily where that product got on the container ship to come here. It's not necessarily where most of its ingredients are from or even where most of the manufacturing happened

-