Credit Risk Modelling Survey

Pinned

Credit Risk

-

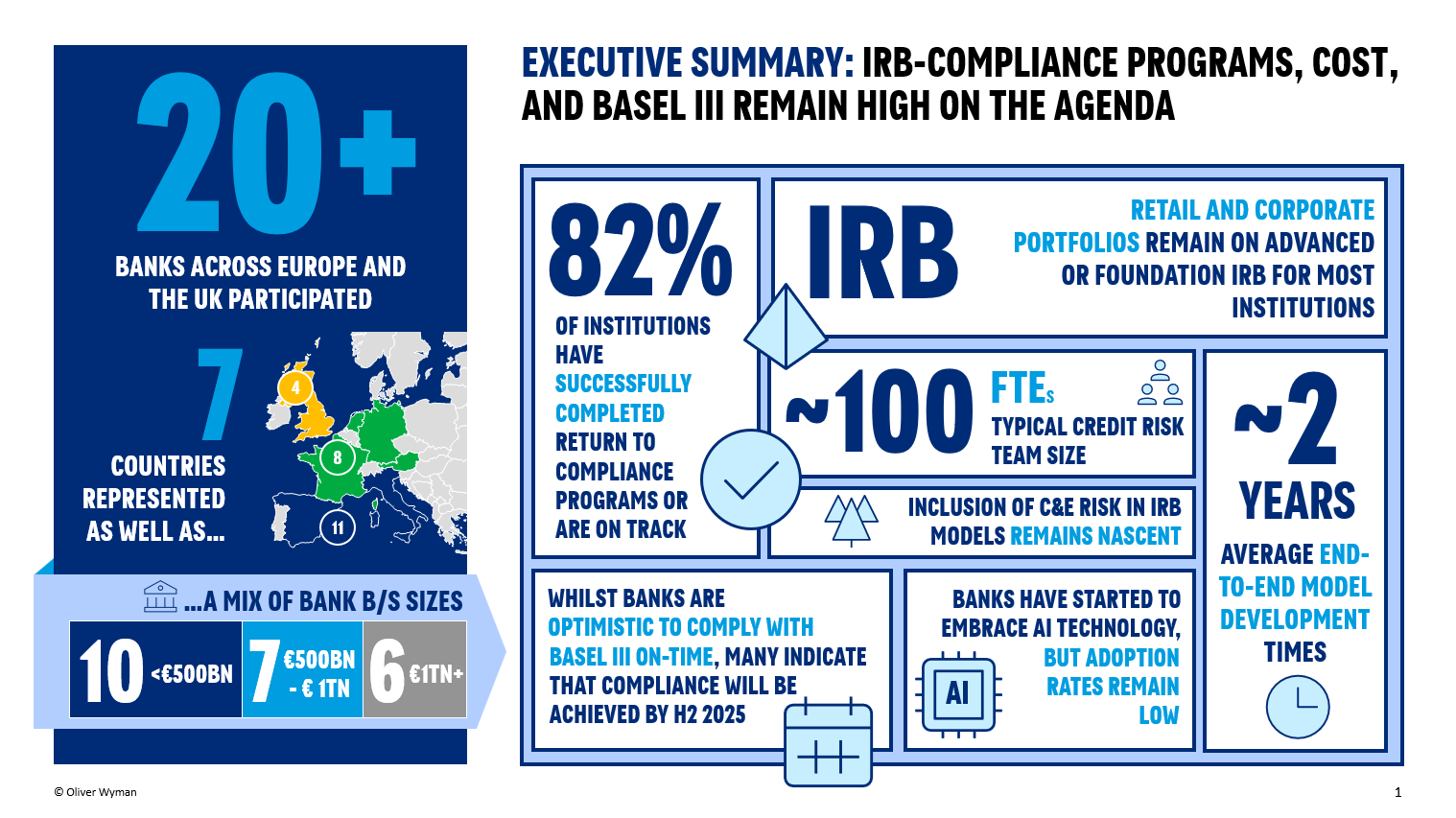

Many of our banking clients have had to contend with the increasing scope of IRB-compliance programs, cost pressures, and Basel III finalisation, there is also the increasing importance of incorporating climate and environmental risks in credit risk modelling, and how best to leverage the advances in AI

It's against this backdrop that Oliver Wyman have conducted a Credit Risk Modelling survey of more than 20+ banks that provides a snapshot of

- Comparative views of Basel III implementation impacts across peers

- Benchmark the efficiency of credit risk modelling capabilities in terms of operational costs and RWAs

- Better understand opportunities and challenges in use of external / pooled data

- Gain insights on emerging industry best-practices in the integration of climate and environmental risks into the prudential framework

- Gauge the automation and AI maturity of your peers to better inform investment decisions

Get in touch for further insights, and post reactions, questions or comments with the RB community below

-

A abbas.razaq pinned this topic on