Credit risk modelling: Driving Efficiency with AI

-

Credit risk modelling: Driving Efficiency with AI

Using AI to build credit risk models is no longer fantasy – we have used an AI agent to build IRB models utilising our Hercules toolkit

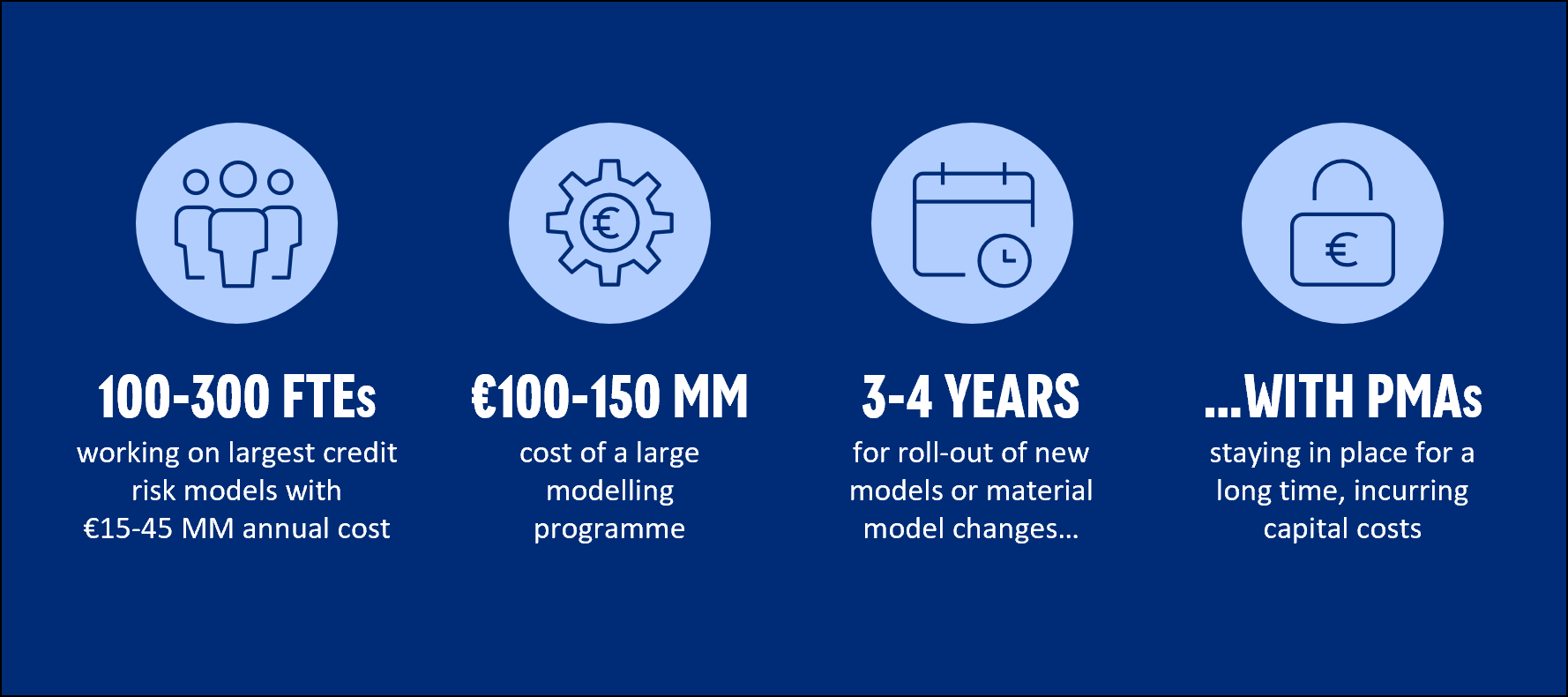

Today’s most complex credit risk models come with substantial costs. Equally, their protracted development phases lead to extended time-to-market.

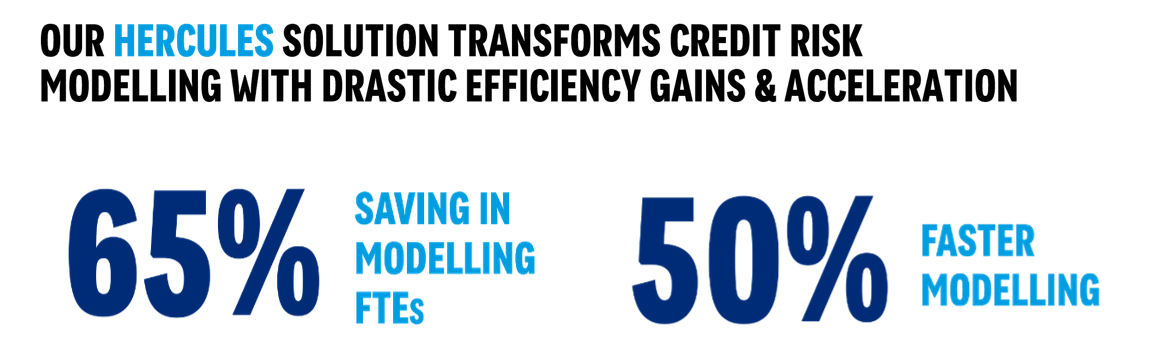

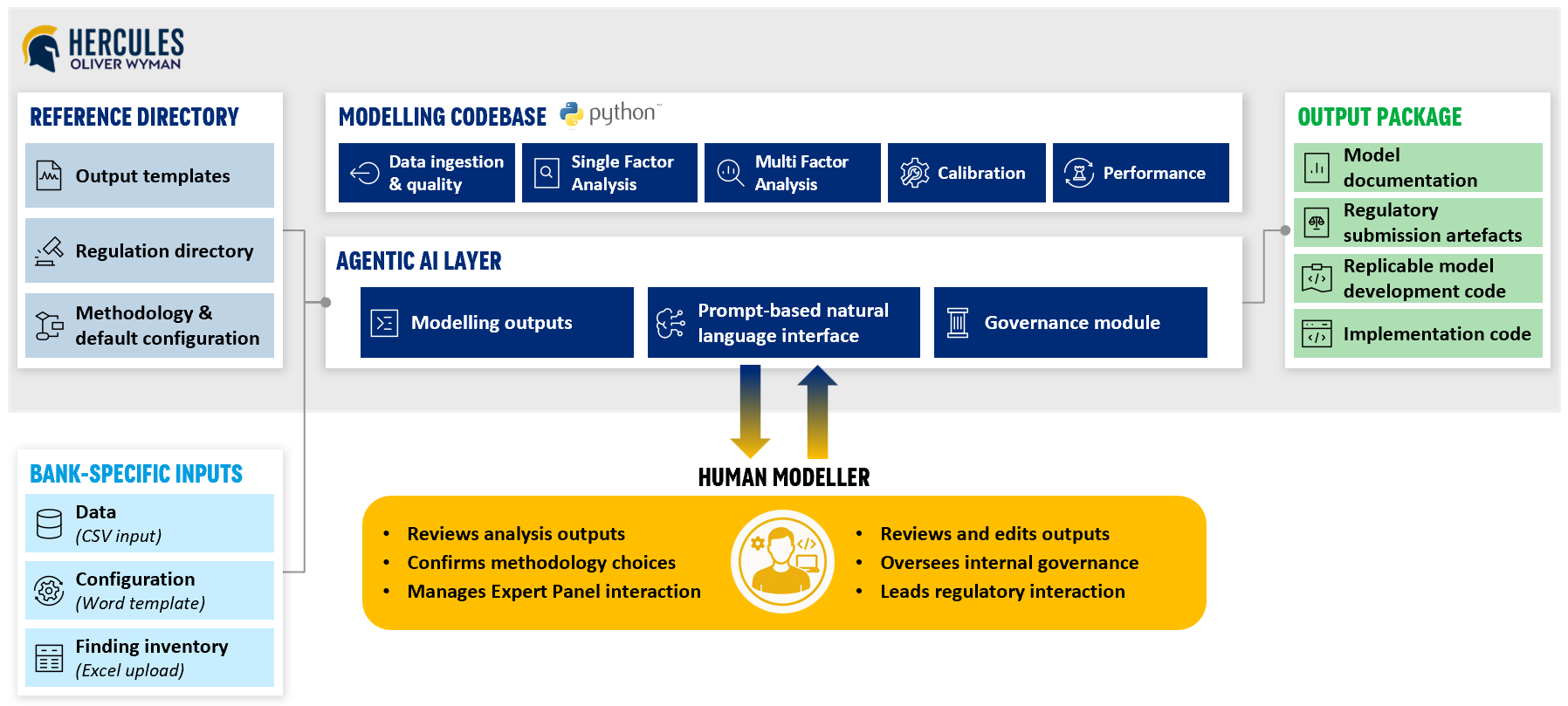

Hercules is Oliver Wyman’s agentic AI solution for credit risk modelling, built upon our proven modelling codebase, methodology, and templates, featuring a no-code, natural language interface for steering and oversight by human modellers

-

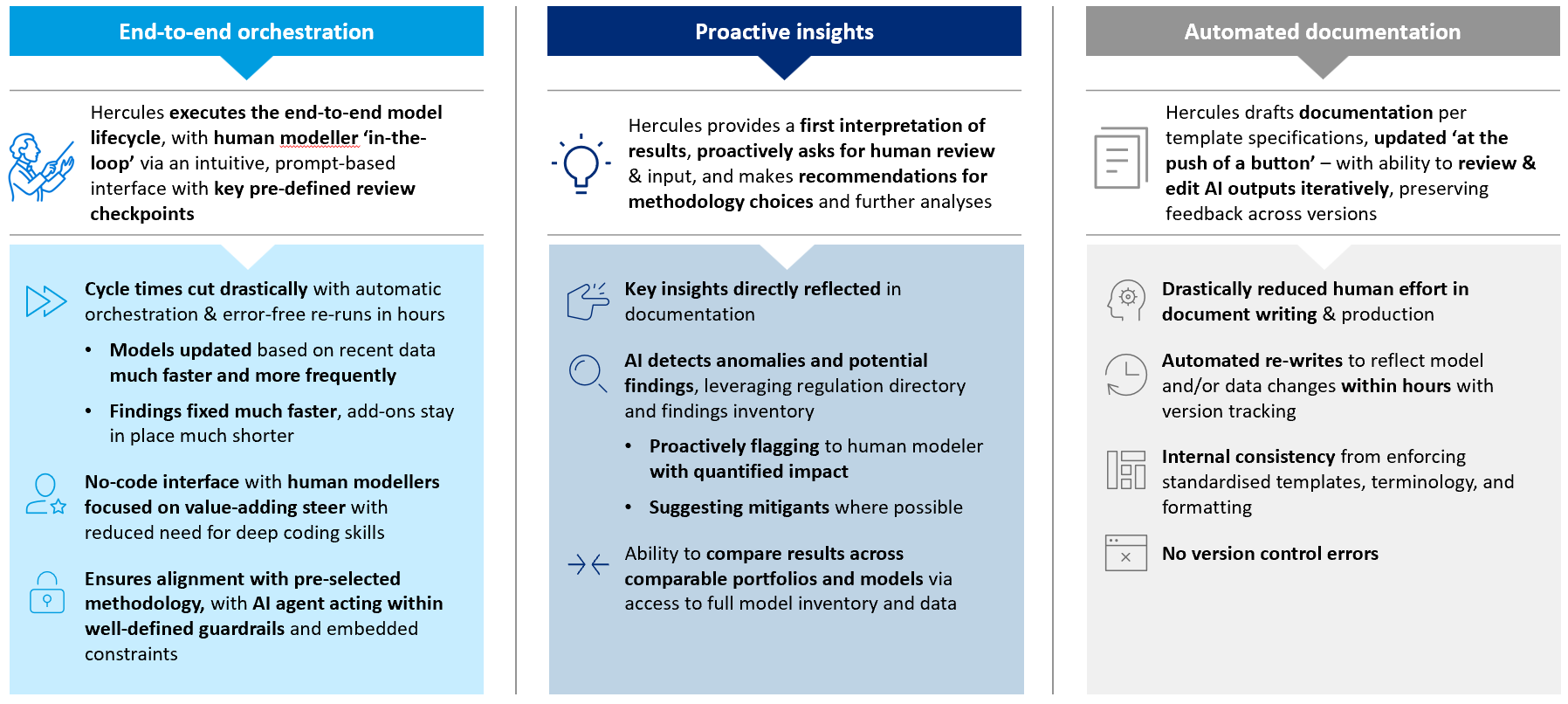

The agentic AI orchestrator executes the end-to-end model development, refinement and/or re-calibration process according to the desired configuration

-

It leverages our production-quality Python codebase, which has been deployed successfully across multiple modelling programmes and validated by both Model Risk functions and regulators

-

Hercules produces a near-final modelling package with model documentation, all required regulatory artefacts and production code

-

Its intuitive interface proactively presents results, options and recommendations for human modellers to review, discuss with experts and approve – ensuring effective ‘human-in-the-loop’ oversight

Hercules combines our proven methodology and codebase with an agentic AI layer to transform credit risk modelling, and designed to support human decision‑making and free-up cognitive capacity by taking care of the mechanical and analytical grunt work

The Hercules’ Agentic AI layer accelerates credit risk model development via end-to-end orchestration, proactive insights and automated documentation

Read more here and get in touch to learn more about how we might be able support you in deploying Hercules

-

-

Is there anyone using AI for credit-risk documentation, monitoring. Our view is it creates generic fluff but since doesnt have full access to credit regulations, full set of models, policies, the answers almost always need rewrite again. If someone trains an internal llm on a set of procedures, documents, it might work, but we dont have budget to test this

-

Banks we are working with are using Co-pilot-like solutions to usually enhance the style / language of documentations or proof read them. In terms of more value-add documentation support, we are working with a number of banks to do what is being suggested here. Using the code-base, governance documents, regulations, model development templates/guides as input, and giving a best example model document in the training set, we are aiming to improve the effectiveness of AI. If interested, we would be happy to demonstrate how this would work to you and colleagues