In the context of the 2025 EBA Stress Testing exercise we’ve convened our sixth EBA Stress Test industry roundtable, involving representatives from 25 of the largest European banking institutions across ten countries.

While each bank is looking to approach the stress testing exercise from its own unique perspective, we’ve found that two common trends seemed to emerge:

-

Banks expect the anticipated depletion of the Common Equity Tier 1 (CET1) ratio under adverse scenarios to align closely with the outcomes seen in 2023.

-

Banks see the operational complexity of the exercise as their main challenge. Participants were concerned about potential CRR3 re-statements (particularly the difficulty in accurately projecting a CRR3 Fully Loaded framework that incorporates all CRR3 phase-ins expected by 2032) as well as the need for top-down calculations to estimate CRR3 compliant RWAs, which could complicate reconciliation efforts and impact result accuracy.

Other concerns raised by participants included the new timeline and significant changes to Quality Assurance processes - especially regarding potential on-site visits and inspections by the European Central Bank (ECB) - and the unpredictability of the new Net Interest Income (NII) platform and Quality Assurance machinery, which banks believe leaves them with less control over projections and adds to the uncertainty of the exercise.

Overall, it was insightful to see how given the inherent complexity of the exercise participants agreed on the need for thorough upfront preparation and a robust end-to-end stress testing infrastructure as conditions to success. What are the main concerns at your organisation? How do you feel your competitors will react to EBA’s requirements for this year’s stress testing?

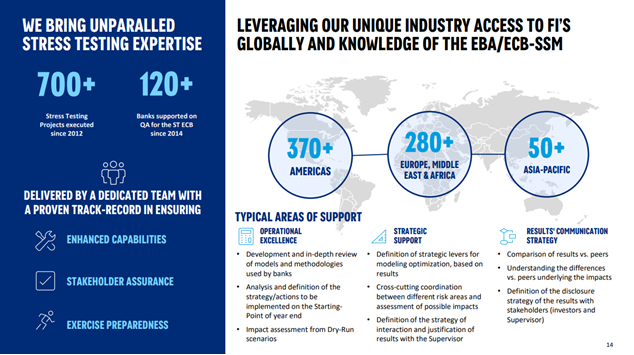

Graphics: How Oliver Wyman supports Financial Institutions carry out stress testing: