Oliver Wyman Tariff Tearsheet - May 29th 2025

-

Today’s Tearsheet explores how the latest judicial challenge to U.S. tariff authority has not reversed momentum, but instead entrenched uncertainty as a structural policy feature. With courts pushing back on emergency tariff powers, and the administration preparing to shift legal footing, trade partners and markets are absorbing a new kind of tariff volatility, not driven by rate hikes, but by regulatory whiplash. Sources include Signum Global Advisors, Autonomous Research, Bloomberg, Reuters, Atlantic Council, BCA Research, Dow Jones Newswire and Oliver Wyman

-

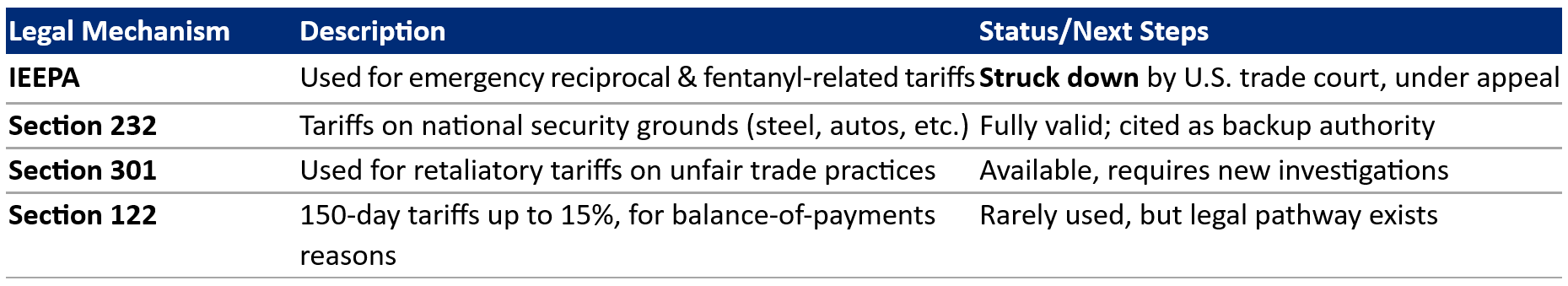

Court ruling halts IEEPA-based tariffs, but Trump’s tools remain intact: The U.S. Court of International Trade struck down Trump’s use of the 1977 International Emergency Economic Powers Act (IEEPA), but the administration is expected to reassert tariffs via Sections 232 of the Trade Expansion Act of 1962, or Sections 301 or 122 of the Trade Act of 1974. Legal volatility now defines the tariff regime. (Signum, Autonomous, Bloomberg, Reuters, Atlantic Council)

-

SCOTUS will narrow tariff powers—but not end the China trade war: A Supreme Court challenge is likely to narrow arbitrary uses of tariffs while preserving national security justifications. U.S.-China trade tensions remain structurally intact. (BCA Research)

-

Regulatory uncertainty is the new constant for financial services: From asset quality to treasury market liquidity, the financial sector now treats trade shocks as part of its core risk environment. (Signum, Autonomous, Bloomberg)

-

Court ruling lowers recession risk in U.S. and Canada: The ruling reduces tariff headwinds, offering monetary policy breathing room in both the U.S. and Canada. (Dow Jones Newswires)

Court ruling halts IEEPA-based tariffs, but Trump’s tools remain intact**

Signum Global Advisors, Autonomous Research, Bloomberg, Reuters, Atlantic Council, 29 May 2025

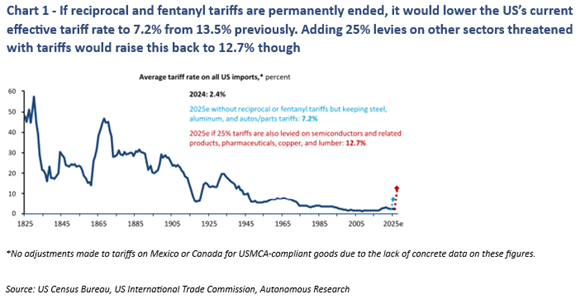

On May 28, the U.S. Court of International Trade ruled that the Trump administration exceeded its authority under the International Emergency Economic Powers Act (IEEPA) when it imposed tariffs targeting fentanyl-related imports and levied reciprocal duties. The ruling invalidates about 6.7 percentage points of tariffs, but analysts widely agree the impact will be muted due to available alternative authorities.

The administration immediately appealed, and the issue is expected to reach the U.S. Supreme Court before its summer recess (late June–early July). Trump is unlikely to back down on tariffs and may escalate further regardless of legal headwinds. Even if courts weaken his authority, he may pivot to other statutory powers (e.g., Sections 232 of the Trade Expansion Act of 1962, or Sections 301 or 122 of the Trade Act of 1974 that gives POTUS wide latitude in matters of trade agreements and tariffs). The mechanism may change, but the intent, and market impact, remains intact, with legal volatility now layered atop an already fragmented global trade environment.

Section 232 – Trade Expansion Act of 1962

- Statute: 19 U.S. Code § 1862

- Authority: Allows the President to impose tariffs or other trade restrictions if imports are deemed to threaten national security.

- Use case: Commonly used for steel and aluminum tariffs. The Commerce Department conducts an investigation, and if it finds a national security risk, the President can act unilaterally.

- Notable use: Trump used Section 232 to impose tariffs on steel and aluminum in 2018, citing national security concerns.

Section 122 – Trade Act of 1974

- Statute: 19 U.S. Code § 2132

- Authority: Allows the President to impose across-the-board tariffs of up to 15% for 150 days (or quotas) on imports if there's a balance-of-payments crisis or major disruption to U.S. trade flows.

- Use case: Intended as an emergency safeguard for short-term trade imbalances or currency disruptions.

- Notable use: Rarely invoked. Considered a fallback option if other authorities are constrained – as is the case now!

Section 301 – Trade Act of 1974

- Statute: 19 U.S. Code § 2411

- Authority: Permits the U.S. Trade Representative (USTR) to investigate and respond to unfair foreign trade practices. The President can impose tariffs, quotas, or other restrictions in retaliation.

- Use case: Used to target countries (notably China) for practices like IP theft, forced tech transfer, and discriminatory licensing.

- Notable use: The legal basis for the bulk of Trump’s China tariffs during the 2018–2019 trade war.

“The tariff levels we had yesterday are probably the ones we’ll have tomorrow.”

— Michael Zezas, Morgan Stanley Research“We’re very, very confident that this really is incorrect.”

— Kevin Hassett, White House NECKey takeaways

- Tariff revenue intact: Goldman Sachs estimates nearly all lost coverage could be replaced via Section 232 (national security) and Section 301 (unfair trade practices), preserving approximately $200 billion in annual revenue

- Limited policy impact: Morgan Stanley calls the court decision “procedural, not strategic,” forecasting continued elevation in trade barriers

- Frozen negotiations: Legal uncertainty could stall talks with trade partners and encourage more fragmented and volatile enforcement strategies

Signum characterizes this inflection point not as a de-escalation, but a structural shift, from blanket tariffs to persistent, legally fortified trade actions. They warn the administration may pivot to narrower, politically targeted measures that offer greater legal defensibility while deepening unpredictability

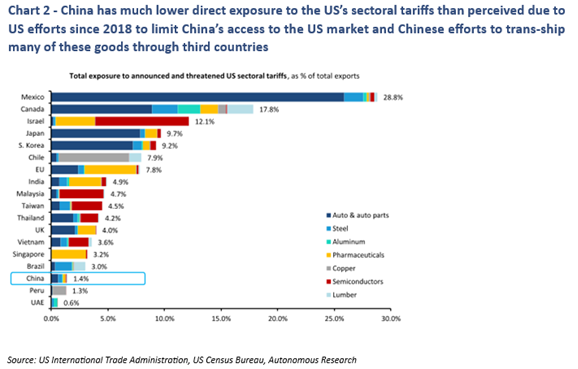

- Shift to narrower actions: Broader executive actions may give way to more sector-specific or country-targeted tariffs. The weakening of Trump’s leverage could reduce foreign governments’ urgency to negotiate, leading him to escalate unilaterally. This further undermines global trade architecture and creates room for non-U.S. trade blocs (EU-Asia, China-MENA) to deepen bilateral ties.

- Emphasis on legal durability: Expect actions anchored in authorities like Sections 232 or 301 to reduce vulnerability to court challenges.

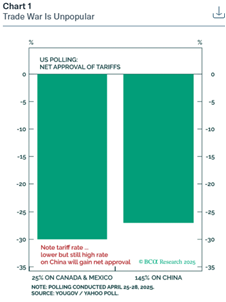

- Greater political calibration: Tariffs may be deployed to appeal to key constituencies or pressure trade partners, rather than system-wide application (i.e. Trump may seek to "prove strength" after the court setback by imposing new or broader tariffs)

- Persistent volatility: Frequent, legally tailored trade actions could introduce regulatory and commercial uncertainty as the new baseline

OW Analysis Legal Authority Landscape: Tools Still on the Table

SCOTUS will narrow tariff powers—but not end the China trade war

BCA Research, 29 May 2025

The latest BCA Geopolitical Strategy Insight argues that the U.S. legal system will constrain, but not derail, the Trump administration’s ongoing trade war, especially with China. The trade war’s legal path may narrow, but its strategic momentum remains, especially in the U.S.-China context.

Rule of law confirmed, powers retained

- The U.S. Court of International Trade ruled tariffs under the IEEPA were improperly applied

- But the Supreme Court is expected to uphold the president’s right to use trade powers, especially when grounded in national security, supply chain risk, or existing trade laws

Tariffs on China to remain

- The ruling will not roll back 30% tariffs already in place against China

- BCA expects that these measures, which reflect bipartisan congressional support, will survive

Judicial friction rising

- The Supreme Court may limit the president’s ability to apply tariffs arbitrarily and force the administration to justify timing, scope, and renewals more rigorously

- Yet, it will affirm executive discretion over what constitutes an emergency or threat

Geopolitical strategy unchanged

- Trade confrontation with China stems from deep strategic rivalry, not short-term policy

- Key factors include intellectual property, military tech transfer, and supply chain control

Regulatory uncertainty is the new constant for financial services

Signum Global Advisors, Autonomous Research, Bloomberg, 29 May 2025

The financial services sector is increasingly internalizing tariff volatility as a structural risk, not just a trade or macroeconomic issue. The latest legal ruling compounds pre-existing pressure points and operational risks. Tariff unpredictability has crossed from policy to portfolio, placing strain on asset quality, liquidity planning, compliance risk management, and client coverage models.

- Credit & asset risk: Aggressive tariff policy and legal volatility could drive elevated defaults among SMEs in trade-exposed sectors (e.g., agriculture, manufacturing), worsening credit quality for banks with concentrated exposure. Ratings agencies may revisit sector-specific downgrades

- Treasury market ripple effects: Legal setbacks affecting tariffs may reduce foreign appetite for U.S. Treasuries, raising yields and tightening dollar funding (as we have discussed in prior Tearsheets). Repo markets and liquidity-sensitive institutions face heightened fragility

- Increased hedging and advisory needs: Rising volatility in commodities, FX, and cross-border supply chains will increase demand for bespoke hedging, structured solutions, and scenario-based advisory

- Legal and compliance exposure: Ongoing shifts in trade authority—IEEPA to 232/301—will require heightened vigilance from legal and compliance teams. Firms will need playbooks for sudden shifts in tariff scope and jurisdiction. As Trump shifts to more discretionary trade tools (e.g., Section 301), policy predictability erodes

Court ruling lowers recession risk in U.S. and Canada

Dow Jones Newswires, 29 May 2025

The trade court ruling also carries important macroeconomic implications, particularly for North America. Bank of Nova Scotia economist Derek Holt identified nearly a dozen macroeconomic implications of the U.S. trade court ruling. While the administration has pledged to appeal, Holt notes that the uncertainty could stretch for months. Importantly, if the ruling holds, Holt argues it could "sharply reduce" the likelihood of recession in both the U.S. and Canada.

Markets may be underpricing the macro importance of this ruling, particularly for central bank policy and North American trade-linked sectors. For now, it supports a more dovish rate outlook and relieves pressure on North American trade-dependent sectors.

- The reasoning: Without immediate tariff escalation, downside risk to consumer prices, corporate margins, and cross-border trade volumes is mitigated.

- Monetary policy flexibility: The ruling gives the Bank of Canada additional reason to hold rates steady in its upcoming meeting, helping anchor financial conditions.

- Lingering risk of escalation: Despite the ruling, the Trump administration could still reinstate tariffs under alternative legal channels (e.g., Section 232, fentanyl-based justification), especially targeting Canada, China, or Mexico

-