Oliver Wyman Tariff Tearsheet – May 22, 2025

-

Today’s Tearsheet highlights how the latest wave of tariff escalation is being internalized (and in some ways mitigated for lower impact), by companies, credit markets, and global trade flows, as a persistent structural feature rather than a one-off policy shock. From margin trade-offs and warehouse arbitrage to mounting household stress and earnings downgrades, the economic response is no longer reactive, it’s adaptive. Sources include Apollo, Signum Global Advisors, Reuters, MedTech Dive, MarketWatch, DHL, Federal Reserve Bank of St. Louis, Investopedia and Oliver Wyman

-

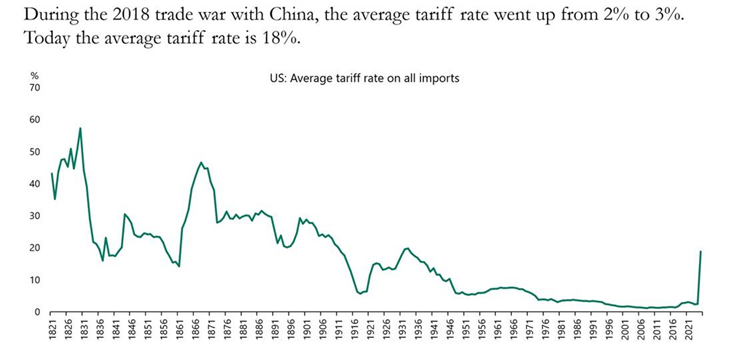

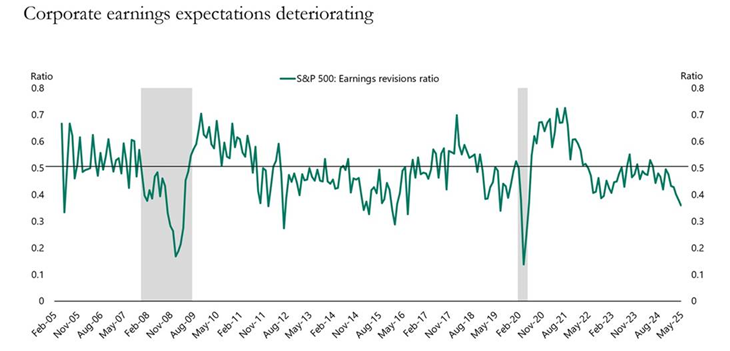

China tariff hikes far outpace 2018, with earnings now feeling the strain: Despite recent deals and pauses, U.S. import tariffs have climbed from 3% to 18% in five months, surpassing the 2018 trade war in scale. But this time, the market reaction is more severe; the S&P 500 earnings revision ratio has dropped below 0.4, as firms cite demand weakness, margin strain, and FX pressure in guidance cuts (Apollo).

-

Corporate margin absorption emerges as key tariff response strategy: Executives at Target, Nestlé, Home Depot, and Boston Scientific are keeping shelf prices stable while accepting margin compression—betting that customer retention and brand equity outweigh short-term profitability. Strategic cost absorption has become the dominant playbook (Signum Global Advisors, Reuters, MedTech Dive, MarketWatch)

-

Tariffs trigger warehouse boom as imports seek flexibility: Bonded warehouses are seeing unprecedented demand as firms rush to import goods but delay duty payments—stretching cash cycles while navigating tariff uncertainty. Logistics hubs from the U.S. Gulf Coast to Singapore are hitting storage capacity limits (Reuters).

-

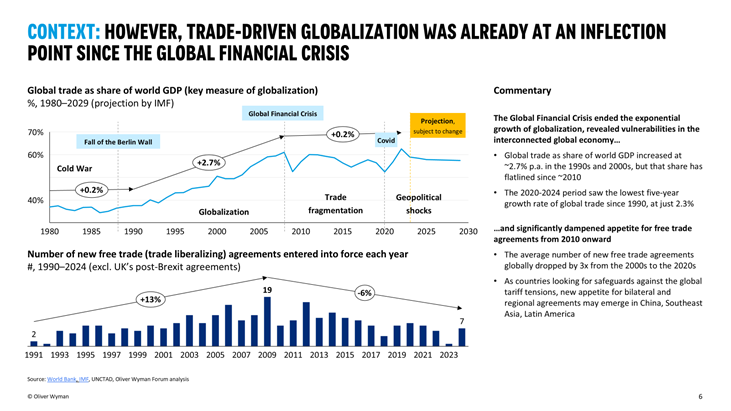

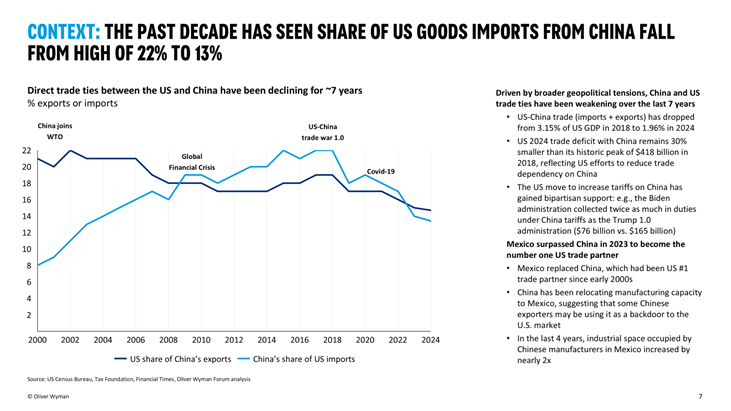

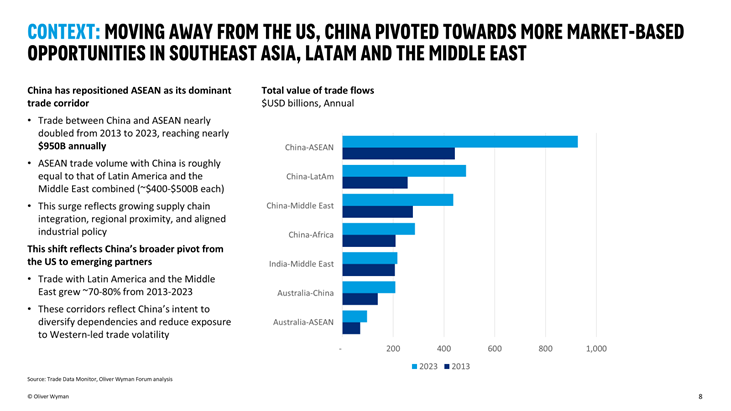

Decrease in global trade flow long preceded tariff turmoil: China’s pivot to ASEAN and the global deceleration in trade volumes began well before recent tariff hikes. But the latest actions are accelerating the shift toward regional supply chains and further weakening already fragile global trade momentum (OW Analysis, DHL, Reuters)

-

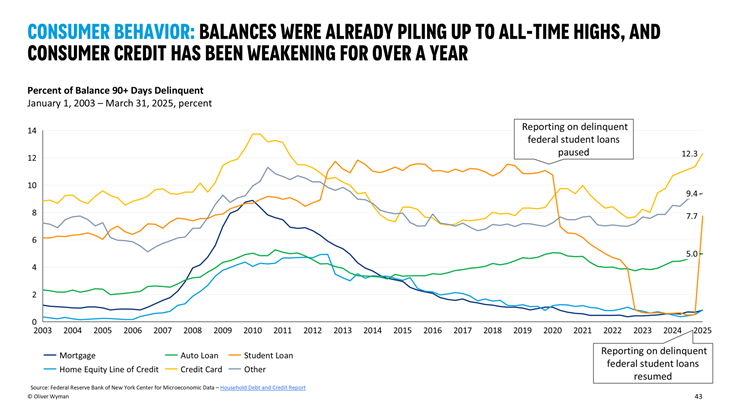

Delinquencies were rising long before tariffs - household stress has deeper roots: Delinquencies on cards and student loans have been climbing since 2023, especially in low-income areas. Tariffs are amplifying existing pressures but are not the root cause; overextension, expiring support, and tighter policy are driving credit deterioration (OW Analysis, Apollo, Federal Reserve Bank of St. Louis, Investopedia, Reuters)

China tariff hikes far outpace 2018, with earnings now feeling the strain

Apollo, 22 May 2025

While the 2018 U.S.–China trade spat saw modest tariff hikes (from 2% to 3%), the current wave of tariff escalation has been far more aggressive, with average U.S. import tariffs rising from 3% in January to 18% today. Despite a partial rollback in China-specific tariffs (from 145% to 30%), the earnings impact is already materializing across S&P 500 companies—indicating this episode may weigh more heavily on corporate fundamentals than past cycles

-

Historical context matters: The 2018 trade war lifted average tariffs by just 1pp, from 2% to 3%. Today’s spike marks the sharpest tariff increase since the 1930s (see Apollo’s historical average tariff rate analysis below). It is expected to have a more sustained impact on profit margins and business investment.

-

Earnings revisions rolling over: Since “Liberation Day”, the S&P 500 earnings revisions ratio has dropped sharply, falling below 0.4 for the first time since mid-2020. The revisions ratio, a proxy for forward earnings momentum, suggests broad-based deterioration in corporate outlooks amid rising costs and macro uncertainty.

-

Macro risk building: With elevated tariffs compressing margins and triggering guidance cuts, investors face growing downside risk. If average tariff levels remain sticky, the hit to EPS forecasts may intensify, particularly for trade-exposed sectors like autos, tech hardware, and industrials

Corporate margin absorption emerges as key tariff response strategy

Signum Global Advisors Webinar, Reuters, Reuters, MedTech Dive, MarketWatch, 22 May 2025

As tariffs push up input costs, a growing number of firms are opting to absorb expenses rather than pass them to consumers. From big-box retailers to medtech giants, protecting price stability, along with brand equity and market share, has emerged as a central strategy. While this cushions consumers in the near term, it raises questions about profit durability and long-term capital discipline.

-

Retailers hold the line on prices: Target CEO Brian Cornell emphasized that price hikes are “a very last resort.” The retailer’s decision to absorb tariff-related costs led to weaker-than-expected earnings and a guidance cut, with near-term margin pressure seen as the cost of preserving customer loyalty

-

Nestlé trades margin for market share: In a high-stakes bet, Nestlé is keeping shelf prices flat despite rising input costs, aiming to capture share from rivals that raise prices. The company lowered its 2025 margin forecast by 100 bps to 16%, citing tariff pressure

-

Strategic absorption and supplier shifts: Home Depot is resisting broad price increases, instead absorbing some costs and renegotiating vendor contracts. The firm is also optimizing SKUs and may discontinue low-margin products to maintain customer-facing stability

-

Medtech takes a long view: Device makers like Boston Scientific and Intuitive Surgical are absorbing an estimated $350M in tariff-related costs this year. Executives cite the need to maintain pricing consistency for hospitals while accelerating U.S. manufacturing investments

Tariffs trigger warehouse boom as imports seek flexibility

Reuters, 20 May 2025

As tariffs squeeze importers’ margins and cloud supply chain visibility, companies are turning to bonded warehouses and flexible storage solutions to gain control. These facilities allow goods to be stored tariff-free until officially sold or distributed, offering cash-flow relief and tariff deferral. The result: a surge in demand across the U.S. logistics and warehousing sector, with similar shifts underway globally.

-

Bonded warehouses in high demand: U.S. importers are racing to convert traditional warehouses to bonded status, enabling goods to be stored without triggering tariffs upon arrival (effectively hitting “snooze” on a shipment). It involves money and it takes time (via a lengthy application process with U.S. Customs and Border Protection), but for big companies that expect tariffs to remain elevated for an extended period, it can make sense

-

30% China duties drive urgency: With tariffs on Chinese imports now at 30%, importers are seeking any tools to preserve liquidity. Bonded warehousing offers critical breathing room, particularly for discretionary and seasonal goods facing uncertain sell-through timelines. It doesn't necessarily save them money as the tariffs have to be paid when the goods are withdrawn from the warehouse. But it allows companies to pay duties in smaller increments as they are sold

-

Logistics sector benefits: U.S. warehousing and 3PL (third-party logistics) firms are experiencing a boom, with near-capacity utilization in major port-adjacent markets. Ports, freight forwarders, and customs brokers all stand to gain from rising throughput and value-added handling

-

Global trend taking shape: Industry analysts note similar trends abroad, with bonded capacity growing in key transshipment hubs like Singapore, Rotterdam, and Dubai, suggesting a broader international warehousing response to tariff-driven trade friction

Decrease in global trade flow long preceded tariff turmoil

OW analysis, DHL, Reuters, Reuters, 19 May 2025

While tariffs have amplified recent disruptions in global trade, much of the realignment predates the current escalation. Structural forces, such as slowing globalization, shifting trade alliances, and long-building U.S.–China tensions, have been reshaping the trade landscape for over a decade. The new tariffs may be accelerating change, but they are not the root cause

-

China’s pivot to ASEAN predated tariffs: China’s exports to ASEAN rose to 16.4% of total exports in 2024—up from 10% a decade earlier, surpassing its exports to both the U.S. and EU. This diversification predated the May tariffs and highlights Beijing’s long-standing strategy to reduce reliance on Western buyers

-

Global trade growth already stagnating: The past five years saw global trade grow at just 2.3%—its slowest rate since 1990. The post-GFC period marked an inflection point for globalization, with the share of global trade in world GDP plateauing

-

Preemptive buyer behaviour in the US: Retailers and manufacturers had already scaled back China exposure before the tariff spike, some by 20–30%. This reflects a broader “China+1” sourcing shift rather than a sudden reaction to tariff policy

-

Embedded dependence, re-routed flows: While direct imports from China have fallen, Chinese components remain embedded in goods assembled in countries like Vietnam and Mexico. DHL calls this the “indirect China trade,” and it’s becoming harder to untangle from global supply chains

-

Supply chain rewiring to continue: Firms in the U.S. and EU are increasingly sourcing from Southeast Asia and Latin America. Whether or not tariffs persist, this rewiring trend is viewed as durable, rooted in risk diversification, not just protectionism

OW Analysis Global trade growth had slowed to multi-decade lows, U.S.–China trade ties were unraveling, and regional supply chains were shifting away from China—even before the latest tariff actions

Delinquencies were rising long before tariffs—household stress has deeper roots

OW analysis, Apollo, Federal Reserve Bank of St. Louis, Investopedia, Reuters

19 May 2025While recent tariffs may add to consumer headwinds, the foundation of weakening credit health was laid well before May. From credit cards to student loans, delinquencies have been climbing for over a year, driven by higher rates, expiring pandemic support, and overleveraged households. Tariffs now risk accelerating what was already a broad-based deterioration in consumer credit conditions

-

Credit card delinquencies on a 10-quarter climb: According to the St. Louis Fed, delinquencies on revolving credit have risen steadily since early 2023, long before tariffs returned to the headlines. Lower-income ZIP codes saw the sharpest deterioration, with 63% increases in late payments since 2021

-

Student loan strain intensifies as pause ends: With the COVID-era pause on federal student loan delinquency reporting officially lifted in 2025, student loan delinquencies have spiked. Apollo estimates that up to 10% of US households could see a credit score decline, cutting access to future borrowing

-

Older borrowers driving defaults: The rising delinquencies are not limited to young graduates; many are older adults holding Parent PLUS loans. This trend, which began in 2023, reflects longer-term repayment risk, not just tariff-driven stress

-

Banks expect higher charge-off - independent of tariffs: JPMorgan forecasts card charge-offs rising from 3.6% in 2025 to 3.9% in 2026. CEO Jamie Dimon attributed the rise to consumer overextension and tight monetary policy, not the new tariff regime

-

Tariffs are a compounding factor - not the cause: Across sources, analysts consistently stress that while tariffs may deepen credit stress, the underlying deterioration began earlier. Rising balances, resumed loan payments, and rate-sensitive debt service burdens were already weighing on households

OW Analysis Even before the April tariff announcements, credit card, student loan, and auto delinquencies had been climbing for over a year, driven by tight credit, inflation, and the expiration of pandemic-era relief. The data suggest tariffs are amplifying, not initiating, the pressure on US households

-