Oliver Wyman Tariff Tearsheet - 6th May

-

Today’s Tearsheet features insights on US tariffs and global trade changes from Oliver Wyman, Apollo, Signum Global Advisors, Financial Times, and the Associated Press

-

Firms’ reactions and rising prices / inflation: Companies are increasingly passing tariff-induced cost hikes to consumers, contributing to expected inflationary pressures over the next six months (OW analysis, Apollo)

-

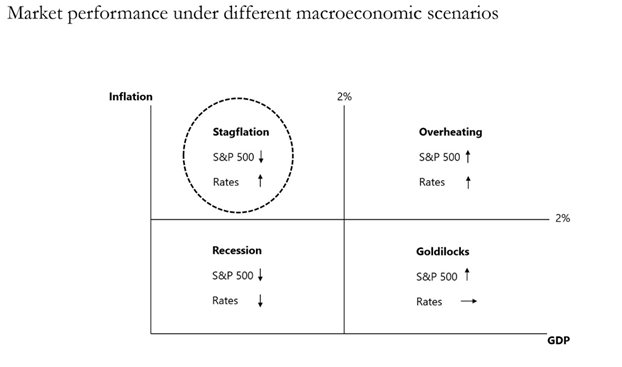

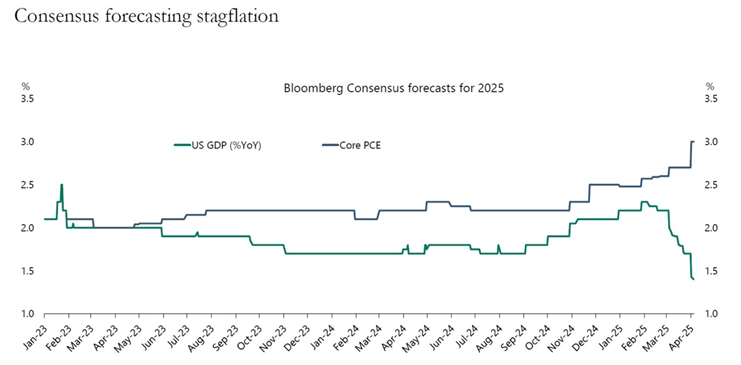

Combined inflation with lower GDP, tariffs may lead to stagflation: The trade war has led to revised economic forecasts, with growth expectations declining and inflation rising, signaling potential stagflation—a troubling mix of low growth and high inflation (OW analysis, Apollo)

-

What might come next for tariff negotiations with China and the EU?: US-China tariff reductions are unlikely in the short term due to China's resistance to new tariff levels and the proposed trade agenda; the EU may be more measured (Signum Global Advisors)

-

It remains to be seen if foreign holders of U.S. debt will play that ‘card’ / ‘nuclear option’ in trade negotiations: Japan holds significant U.S. Treasury assets, which could be leveraged in trade negotiations. However, historical diplomatic strategies suggest a preference for negotiation over confrontation (OW analysis, Financial Times, Associated Press)

Firms’ reactions and rising prices / inflation: How are firms responding to higher tariffs?

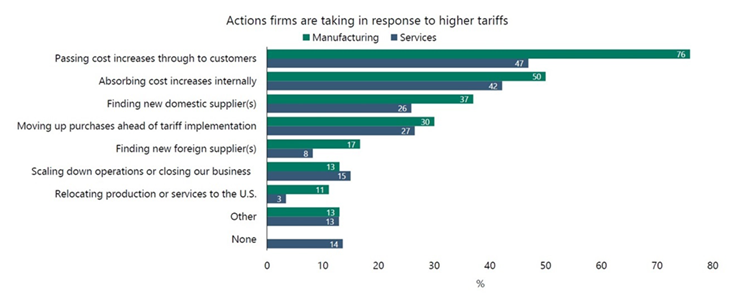

Oliver Wyman analysis, Apollo, 5th May 2025The Fed survey released this week shows how companies are responding to higher tariffs, and the first chart below shows that the top response is that companies are passing cost increases through to consumers

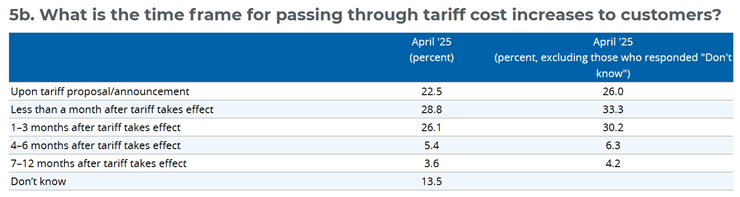

This passing along of costs is expected to take place in short-order, with some firms (26%) implementing changes even before tariffs take effect

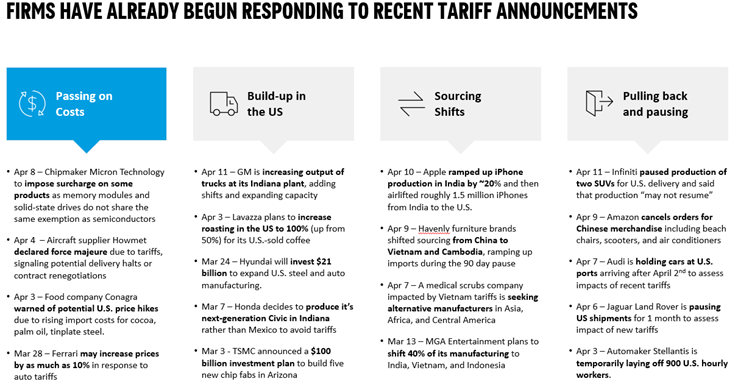

Further Oliver Wyman analysis has aggregated various examples of how firms have begun responding to tariffs throughout April

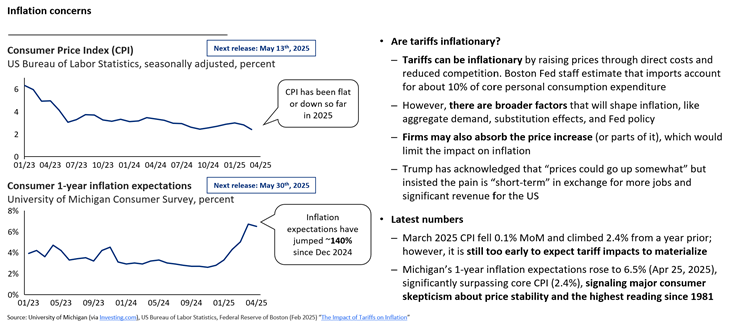

Post-tariff inflation may take some time to materialize, but consumers are expecting significant price increases as a result

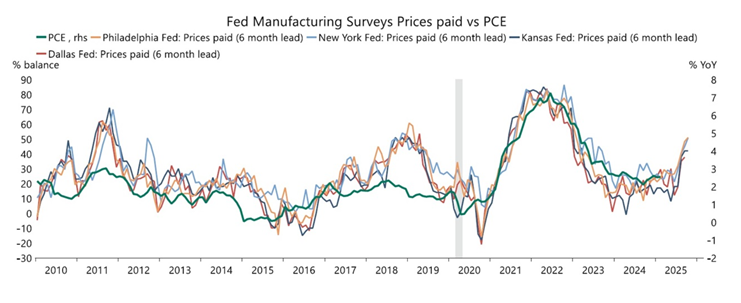

The bottom line is that inflation will likely be rising significantly over the next six months as reflected by rising input costs for manufacturers, compared here against PCE (personal consumption expenditure) in the chart below

Combined inflation with lower GDP, tariffs may lead to stagflation

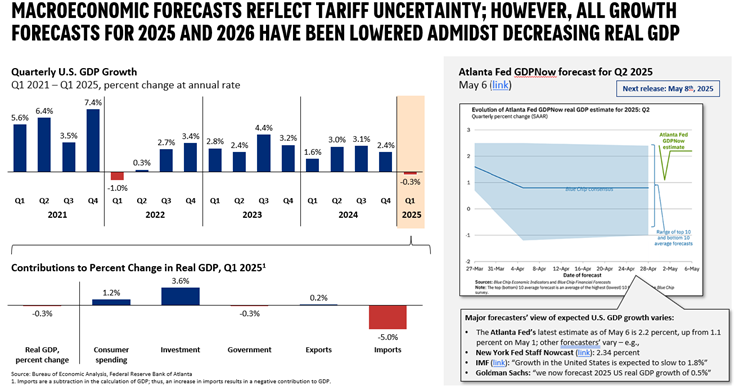

Oliver Wyman analysis, Apollo, 3rd May 2025)Since the onset of the trade war in March, there has been a notable revision in economic forecasts. Growth expectations have decreased, while inflation expectations have increased (as reflected above), indicating the onset of stagflation—characterized by higher inflation coupled with lower growth

Investor Behavior: Current market trends reflect these strategies:

- Short Interest Surge: There is a significant increase in short interest in small-cap companies, reaching levels not seen in years.

- Russell 2000 Vulnerability: Approximately 40% of companies in the Russell 2000 index report negative earnings. These companies, particularly in the middle market and small-cap sectors, face compounded challenges due to:

- Higher Tariffs: Increasing operational costs.

- Slower Growth: Reduced market demand.

- Higher Interest Rates: Elevated borrowing costs as inflation persists.

Federal Reserve Reactions: The Federal Reserve will likely keep its key short-term interest rate unchanged Wednesday, despite weeks of harsh criticism and demands from President Donald Trump that the Fed reduce borrowing costs. Powell and many of the other 18 officials that are on the Fed’s rate-setting committee have said they want to see how Trump’s tariffs affect the economy before making any moves. Without tariffs, economists say it’s possible the Fed would soon reduce its benchmark rate, because it is currently at a level intended to slow borrowing and spending and cool inflation. Yet the Fed can’t now cut rates with Trump’s broad tariffs likely to raise prices in the coming months

What might come next for tariff negotiations with China and the EU?

Signum Global Advisors, 2 - 3 May 2025China: Despite recent optimism, a reduction in US tariffs on China is likely weeks away due to China's resistance to both the new tariff levels and the proposed trade agenda.

Views on Tariff De-escalation:

- Short-term Outlook: Unlikely within the first 30 days (before mid-May)

- Medium-term Outlook: Possible within 30 to 90 days (mid-May to mid-July)

Reasons for Delayed Tariff Walk-back:

-

China's Resistance to New Tariff Levels: China is expected to initially reject the adjusted tariff rates proposed by the US

-

China's Resistance to Trade Agenda: Fundamental opposition to the US's proposed agenda for trade talks, especially regarding the revisiting of purchase agreements from the January 2020 trade deal, as indicated by US Treasury Secretary Scott Bessent's plans

Additional Considerations:

- Logistical Issues and Lack of Trust: These factors further complicate the timeline for tariff de-escalation

European Union: The EU is considering imposing tariffs on specific goods rather than broad categories, which helps minimize economic disruption while sending a clear message to the US. This approach excludes services like Big Tech and US banks, which are more sensitive and could lead to significant retaliation from the US. Despite potential US tariff increases post-July 8, the EU is unlikely to adopt a more aggressive stance similar to China's approach

Reasons for Current Focus:

-

Intra-EU Unity:

-

Balancing Member States' Opinions: The European Commission aims to harmonize the diverse perspectives of member states, where more dovish countries favor negotiation over confrontation. This balance is crucial to maintaining unity and ensuring any retaliatory measures are widely supported

-

Diplomatic Consensus: EU diplomats emphasize the importance of collective decision-making, focusing on strategies that align with both hawkish and dovish members, thereby preventing internal divisions that could weaken the EU's position

-

-

Risk of Escalation:

-

US Concerns Over Digital Taxes: The US has criticized Europe’s digital services taxes, claiming they unfairly target American companies. This issue is a contentious part of ongoing negotiations, and further targeting of US tech could exacerbate tensions, potentially leading to increased tariffs or trade barriers

-

Avoiding Trade War: Dovish EU members caution against actions that could provoke a trade war, stressing that maintaining open dialogue is essential to resolving disputes without escalating them further

-

-

Cumulative Effects of Restraint:

-

Previous Tariff Measures: The EU had agreed on retaliatory tariffs in response to US steel and aluminum tariffs but chose not to implement them immediately. Any new measures may be enacted alongside these, which could amplify their impact

-

Strategic Caution: For dovish member states, combining multiple tariff packages could be perceived by the US as disproportionately aggressive, discouraging them from agreeing to extensive new tariffs

-

Post-July 8 Dynamics:

-

Potential US Tariff Increase: If the US reverts to a 20% tariff, it might prompt the EU to consider employing its anti-coercion instrument, allowing for broader and more forceful responses. This tool is designed to counteract economic pressure from other nations

-

Leverage in Negotiations:

-

Weak Precedent for Aggression: The EU's current restraint in tariff implementation suggests a cautious approach, setting a precedent that may continue post-July 8. This indicates a preference for stability over escalation

-

China's Influence: While China has responded to US tariffs with aggressive, reciprocal measures, the EU is unlikely to follow suit due to differing strategic priorities and economic relationships

-

Limits on EU Action: The EU's approach is tempered by its unwillingness to endure prolonged tariffs or match China's aggressive stance, focusing instead on diplomatic solutions

-

It remains to be seen if foreign holders of U.S. debt will play that ‘card’ / ‘nuclear option’ in trade negotiations

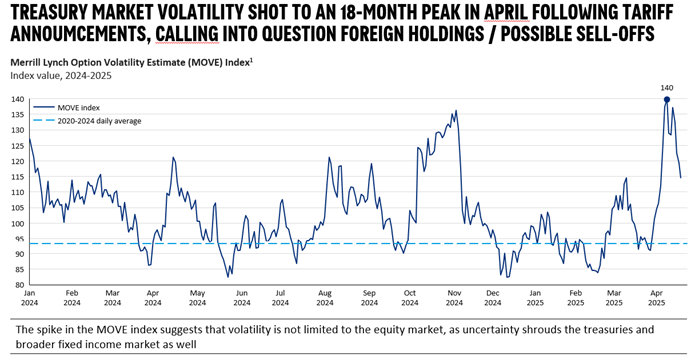

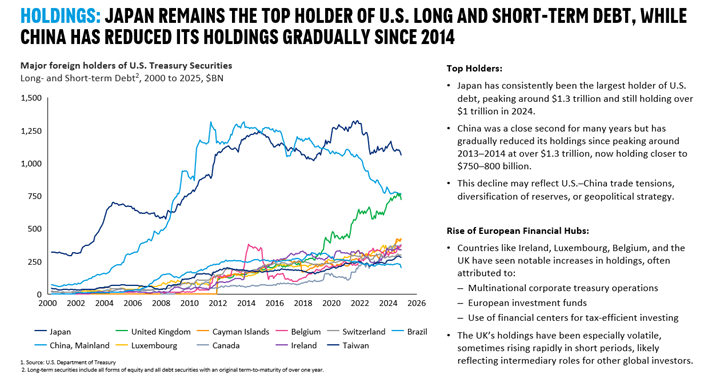

Oliver Wyman analysis, Associated Press, Financial Times, 6th May 2025It remains to be seen (data is still pending on international capital flows and tracking by the U.S. Department of Treasury) whether foreign holders of U.S. Treasuries, such as Japan and China, will utilize their significant holdings as leverage in trade negotiations, particularly in response to tariffs imposed by the Trump administration. This strategic decision could have profound implications for international trade dynamics and financial markets

Japan’s US Treasury Holdings

-

Strategic Asset: Japan holds approximately $1.13 trillion in U.S. government debt, making it the largest foreign holder. This substantial investment represents a significant portion of Japan's foreign reserves and serves as a strategic asset in international economic relations

-

Potential Leverage: In the context of trade negotiations, Japan could theoretically use its Treasury holdings as leverage. The threat of selling off these bonds might influence U.S. policy decisions, given the potential impact on U.S. interest rates and financial stability. The possibility of using Treasury holdings as leverage adds complexity to negotiations

-

Recent Statement by Japanese Finance Minister: Katsunobu Kato's comments suggest that Japan is considering its options carefully. While he acknowledged the Treasury holdings as "a card on the table," he stopped short of indicating any immediate action, reflecting a cautious diplomatic approach

-

Historical Context: Historically, Japan has avoided using economic tools in a confrontational manner, preferring negotiation and consensus-building. This stance aligns with Japan's broader diplomatic strategy of maintaining stable bilateral relations

Overall Asian Treasury Holdings:

-

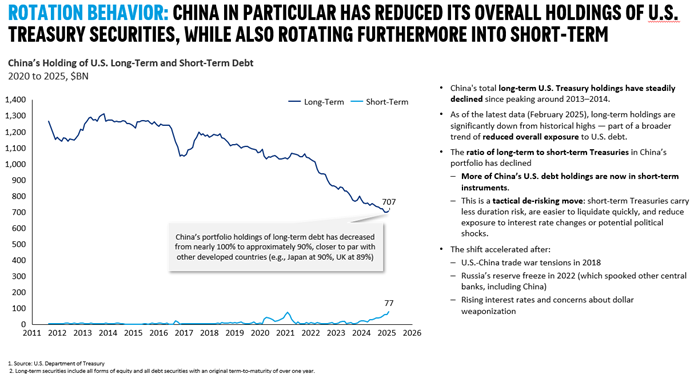

Regional Stability: Asian countries, including China, have maintained relatively stable holdings of U.S. Treasuries. However, the specter of trade tensions raises concerns about potential shifts in investment strategies

-

Rotational Behaviour: Though relatively stable overall, China has strategically started to rotate some of its holdings from long-term to short-term

-