The Brave New World in Credit Decisioning - Oliver Wyman's Lending Transformation Survey

-

Conversations with our clients reveal the imperative of realizing the benefits from the promise of digitally transforming credit decisioning and lending journeys, driven by the need to control bank costs and retain customer loyalty in the face of competition from more nimble, digitally-native banks

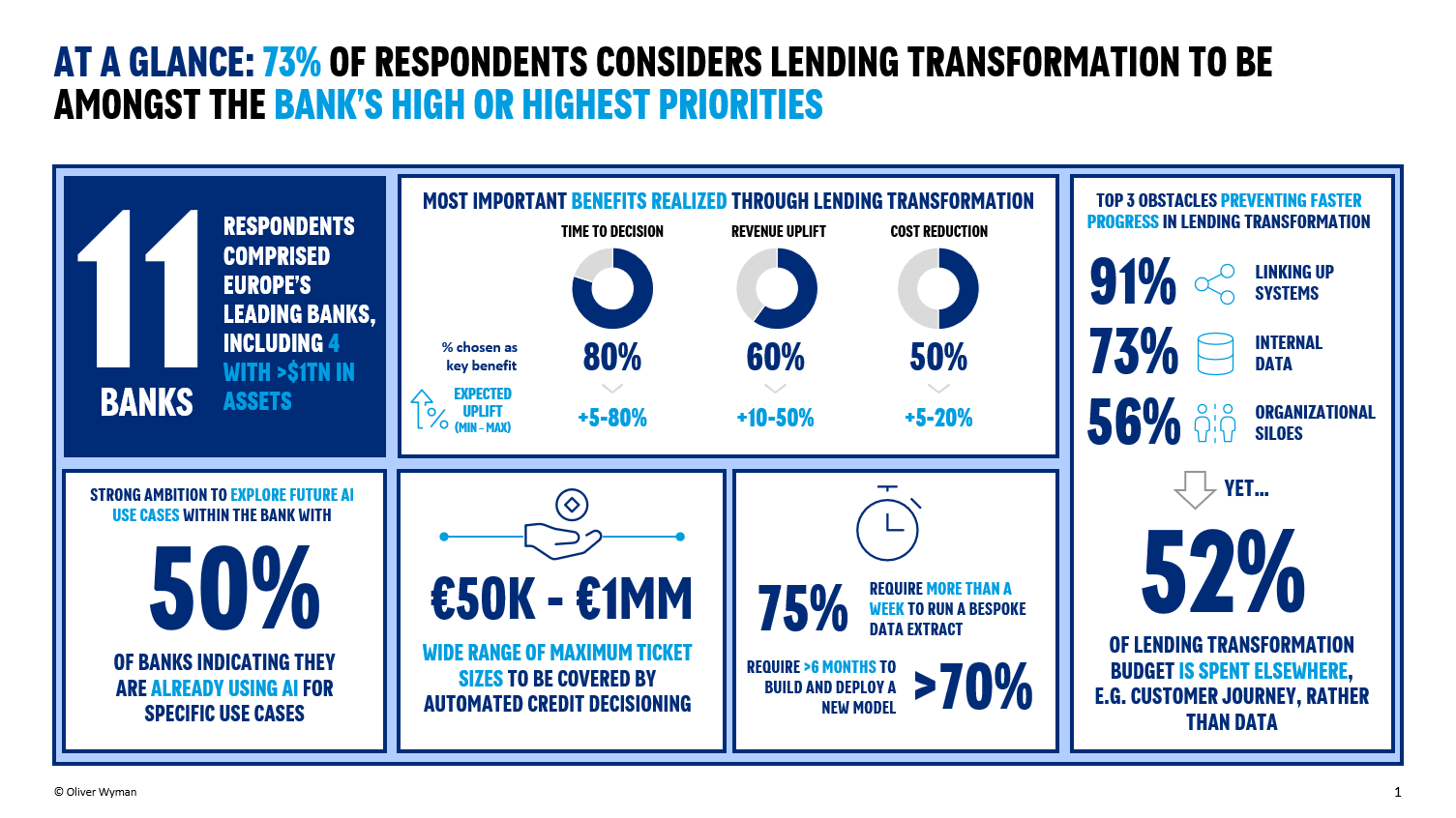

To better understand current trajectories in the lending transformation space, Oliver Wyman conducted a survey of banks across several markets, looking at the overarching burning platform, budgets, barriers to transformation, data, analytics, underlying technology, customer management, and organisational setup. In summary, our high-level, selected findings indicate

- Lending transformation is a high priority topic, with participants sequencing Retail and SME first in their lending transformation programs

- Respondents see the traditional incumbent breakthrough as the biggest competitive threat over the new fintech challenger looming on the horizon

- Decisioning time, revenue growth and cost reduction cited as top 3 benefits, whilst expected uplift is highest for customer experience

- Budget for lending allocation is approached on program level or on individual level, with very few respondents approaching it as a strategic objective

- Most budget is spent on customer journeys, internal workflows and underlying IT infrastructure rather than analytics capabilities

Reach out for more insight, but we’d be keen to hear from the RiskbOWl community how this stacks up against your lending transformation program – post your thoughts below !