Beyond Box-Ticking: Strategic Consequences of the EU’s AML Authority

-

Beyond Box-Ticking: Strategic Consequences of the EU’s AML Authority

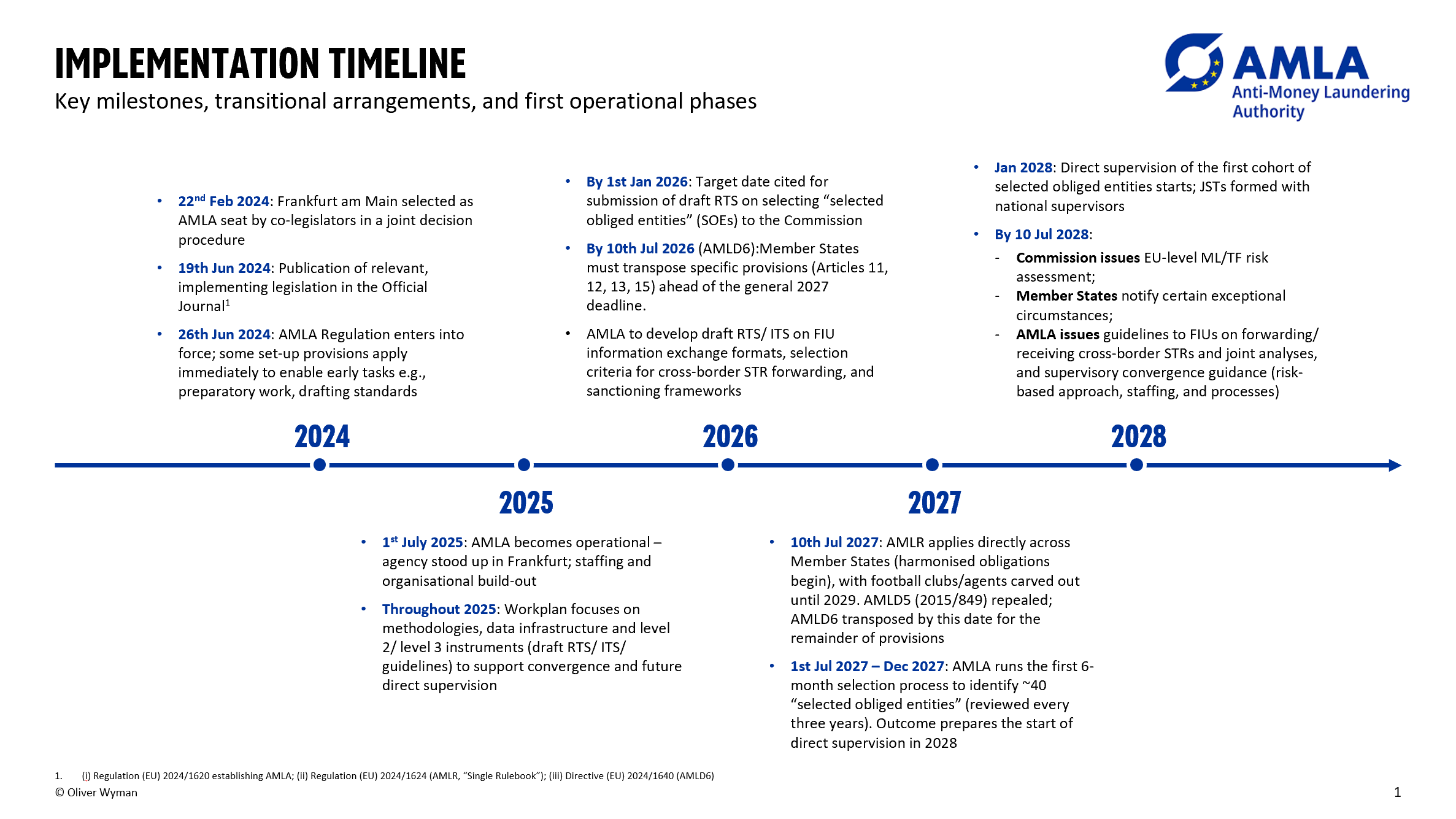

The establishment of the EU Anti-Money Laundering Authority (AMLA) under Regulation (EU) 2024/1620 marks the most significant change in the bloc’s approach to financial crime since the first AML Directives. Tasked with directly supervising high-risk, cross-border financial institutions and coordinating national authorities, AMLA will reshape compliance standards, operational structures, and business models. This article analyses the regulatory framework, timeline, and impacts on banks across the EU from 2024 to 2028. Key implications include higher compliance costs, harmonised supervisory expectations, closer scrutiny of crypto-asset service providers, and opportunities for early movers to leverage compliance excellence as a competitive advantage

Why the AMLA was created

Europe’s AML/CFT regime has long suffered from fragmented national implementation of directives, uneven supervision, and weak enforcement. Scandals involving large banks highlighted gaps in cross-border coordination and beneficial ownership transparency. To align with FATF expectations and restore confidence in the single market, the Commission’s 2021 AML package introduced a Single Rulebook (Regulation (EU) 2024/1624), a new Directive (AMLD6), and AMLA as a central authority

Legal Framework: AMLA’s statutory powers, supervisory scope, and enforcement tools

Core Legal Basis

-

Regulation (EU) 2024/1620 establishes AMLA, conferring on it powers to directly supervise “selected obliged entities” in the financial sector, coordinate and oversee AML/CFT supervision across Member States, support and coordinate Financial Intelligence Units (FIUs), issue guidelines, regulatory technical standards, recommendations, and enforce its own decisions in certain cases

-

The AML Package includes the AML Regulation (EU) 2024/1624 (providing a Single Rulebook), AML Directive (EU) 2024/1640 (AMLD6), and other instruments (e.g. for transfers of funds / crypto transfers). These combine to broaden obligations and reduce national discretion

Supervisory Scope

AMLA will have two main supervisory modalities

-

Direct supervision of selected obliged entities, which are financial sector entities (credit institutions, investment firms, insurance undertakings, crypto-asset service providers, etc.), satisfying criteria of:

-

Operations in at least six EU Member States (by branch or via freedom to provide services)

-

A high ML/TF risk profile as assessed by AMLA (“inherent” and “residual” risk)

-

First selection expected to cover around 40 entities/groups, with selection every 3 years

-

-

Indirect supervision / Coordination / Convergence: For all other obliged entities, supervision remains with national authorities, but AMLA will set binding technical standards (via Regulation), issue guidelines and recommendations, conduct annual or periodic reviews of supervisory authorities’ performance, coordinate peer reviews, facilitate cooperation among FIUs, resolving supervisory disagreements cross-border, etc.

Enforcement Tools

-

For selected obliged entities, AMLA will have administrative measures including orders for corrective measures, temporary bans on persons, etc.

-

Ability to impose pecuniary sanctions for serious, repeated or systematic breaches of the AML Regulation, including periodic penalty payments to ensure compliance

-

Transparency: public naming of decisions in certain cases. National authorities for non-selected entities will be expected to follow AMLA guidelines. AMLA may issue warnings if a Member State fails to correctly apply EU rules

Other Powers

-

Monitoring and assessing ML/TF risks in the EU internal market and wider world; gathering data; establishing a central information database accessible to national and EU supervisors

-

Overseeing FIUs: facilitating joint analyses of suspicious cross-border transactions, improving secure information exchange (FIU.net), training, technical / IT support

Transitional arrangements will include grace periods for some obligations, phasing of enforcement powers, and continuing national supervision (with cooperation) until direct supervision kicks in. Entities selected will likely receive notice ahead of time and have reasonable notice to adjust. Some technical standards / guidelines will apply from earlier dates or upon issuance

Operational Impacts for Banks

Banks and other obliged entities will need to adjust multiple aspects of their compliance operations. Key areas where operational impacts are likely (2024-2028):

Customer Due Diligence (CDD)

-

Stricter beneficial ownership requirements under AMLD6

-

Enhanced due diligence for politically exposed persons (PEPs), high-risk jurisdictions, cross-border/onboarding of clients in other Member States. The risk-based approach will be standardised across the EU, reducing margin for national variation

-

More detailed ongoing monitoring obligations, review of residual risk, more frequent updates to CDD records

Transaction Monitoring and Suspicious Transaction Reports (STRs)

-

Given AMLA’s mandate over joint analyses (FIU cooperation) and monitoring, banks will need to ensure transaction monitoring systems are capable of producing information that supports cross-border patterns, large and complex transactions, crypto flows, etc.

-

STR submission standards may become more unified; expectations for timeliness, quality, and use of analytics will increase

Sanctions Screening

-

Integration of sanctions compliance with AML/CFT obligations will become even more crucial, particularly since AMLA’s powers include ensuring selected obliged entities have appropriate internal policies for targeted financial sanctions, asset freezes etc.

-

Increased overlap among AML, CFT, sanctions regimes (national, EU, international) will require more centralised functions in many banks

Crypto-Asset Service Providers (CASPs) Oversight

-

CASPs are expressly included as possible “selected obliged entities.” They will be subject to direct supervision if they meet cross-border / risk criteria

-

Even for non-selected CASPs, the indirect supervision and technical standards will raise the floor, requiring improved controls, transaction traceability, monitoring of crypto-asset transfers

Data and IT

-

AMLA will maintain a central information database; banks will need to ensure data compatibility, submission of required data, quality, timeliness

-

Upgrading or enhancing transaction monitoring systems, STR analytics, AI/ML tools; cross-border data flow infrastructure; strong model governance

Onboarding/ Offboarding

-

Uniform rules will reduce some of the friction caused by national differences, but the cost of adjusting onboarding policies, risk classification, escalation procedures, enhanced due diligence will be non-trivial.

-

Offboarding (client exit) decisions may be more scrutinised in cross-border / high risk settings

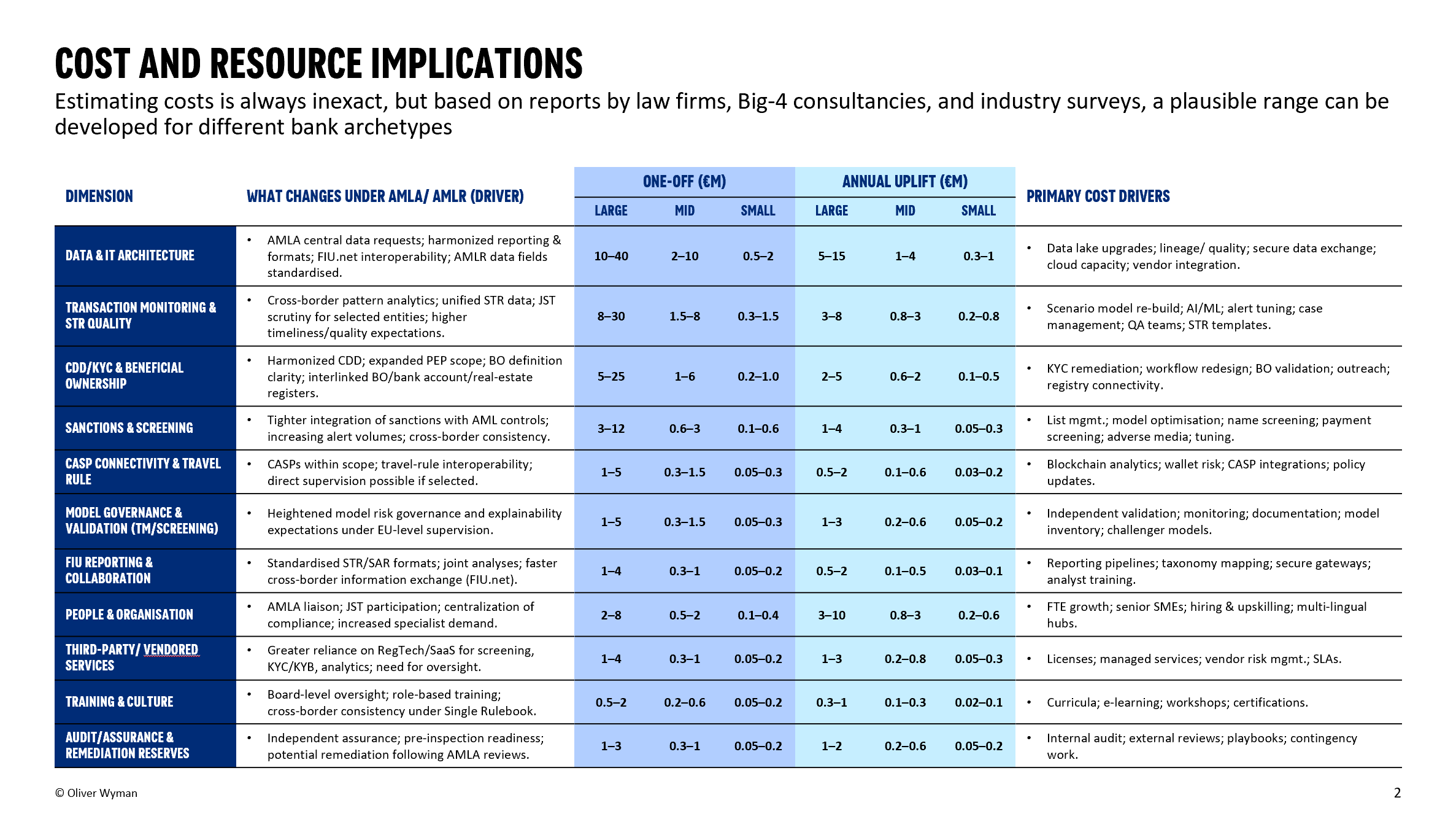

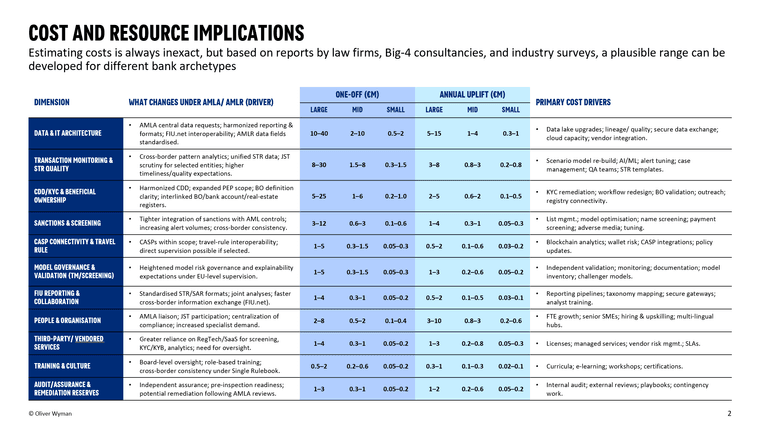

Drivers of cost

-

System and data architecture upgrades (including analytics, AI/ML, cross-border data flows)

-

Hiring or reallocating compliance, legal, risk personnel; possibly setting up dedicated “AMLA preparation/ liaison” functions

-

Training and change management across country teams and business lines

-

Remediation of past weaknesses: e.g. beneficial ownership, lack of consistent policies, documentation gaps

-

External advisory, audit / validation cost

Savings / possible offsets

-

Over time, standardisation may reduce duplicated effort across national jurisdictions

-

Shared services (e.g. central transaction monitoring, vendor-provided screening) may achieve economies of scale

-

Improved automation, better analytics reducing false positives or inefficiencies

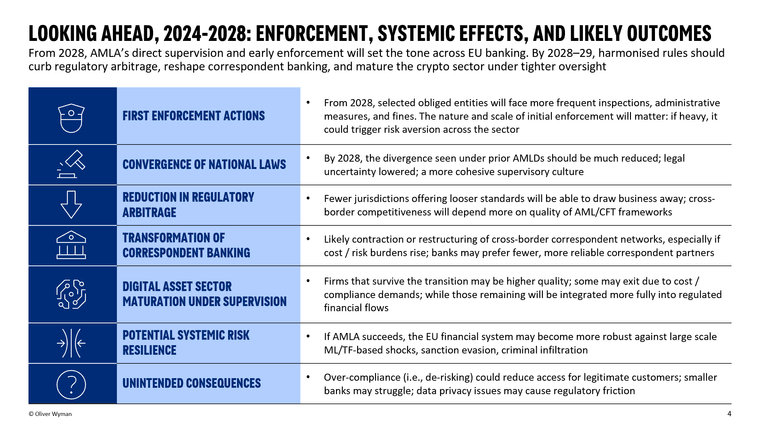

Strategic Business Model Implications

-

Cross-Border Operations and Correspondent Banking

-

Banks with large cross-border footprints will be under direct AMLA supervision; this increases risk (regulatory, compliance, reputational) but also relative advantage for those who perform well

-

Correspondent banking relationships may be scrutinised more closely; some banks may “de-risk” by terminating or reducing exposure to jurisdictions or partners with weak AML/CFT track records. This would reduce correspondent banking network densities

-

-

Crypto Services

-

Firms engaged in crypto-asset services are part of the scope; those with cross-border operations and high risk are likely to be directly supervised.

-

Crypto service providers and the financial institutions that interface with them will need to close gaps in transfer traceability, origin/destination controls, screening, etc.

-

-

Client Onboarding/ Offboarding

-

Stricter uniform CDD and enhanced due diligence will likely slow onboarding for high risk / cross-border / crypto clients

-

Banks may re-evaluate acceptance criteria. Offboarding decisions may become riskier, especially in jurisdictions or with clients triggering systemic risk

-

-

Reputation, Risk Appetite and Business Lines

-

Reputational risk will amplify failures in AMLA’s directly supervised entities will likely draw EU-level attention and public naming; non-selected entities, while under national supervision, will still face scrutiny via AMLA’s reports, peer reviews, etc.

-

Banks may adjust risk appetite: reduce exposures in high-risk jurisdictions; shift business lines less exposed to ML/TF risks

-

-

Competitive Opportunity

-

Those banks that prepare early and demonstrate strong AML/CFT frameworks may benefit lower cost of compliance in the medium term

-

Ability to serve high risk clients more credibly; help with cross-border business; possible regulatory “trust premium.”

-

-

Governance and Organisational Change

-

Risk appetite & oversight: Boards and senior management must engage more directly; AML/CFT must be elevated in enterprise risk frameworks, with clearer metrics, KPIs

-

Lines of defence: First, second, third lines will need clearer roles: compliance units, internal audit, legal will need to coordinate; possibly new roles for liaison with AMLA; stronger independence

-

Incident response: Prepare for more inspections / audits; better readiness for regulatory investigations; crisis communications (reuse of reputational risk)

-

Shared services: Many banks will centralise compliance functions to avoid duplication across regions; consider internal centres for excellence

-

-

Technology and Data Requirements

-

Standardisation: Uniform data definitions, standardised risk scoring, harmonised reporting templates across EU; data models that meet AMLA’s technical standards

-

Analytics / machine learning tools: To detect cross-border suspicious patterns, large transaction volumes, crypto flows, link networks of entities

-

FIU integration and secure data exchange: Banks must ensure that systems can interoperate with FIU requirements, central database; privacy and security; resilience

-

Model governance: More robust validation of AML/CTF models; oversight of AI/ML components; assurance of explainability particularly under enforcement.

-

Operational infrastructure: Real-time or near-real time screening (transaction, sanction, PEP etc.), scalable data storage, audit trails

-

Recommendations: Strategic Priorities for Banks

To manage the transition and exploit opportunities, banks should consider the following strategic priorities:

Short-Term (2024-2026)

-

Gap analysis / readiness audit: assess current AML/CFT frameworks against AML Regulation / AMLD6 / AMLA draft technical standards; especially for cross-border operations, CDD, sanctions, crypto

-

Stakeholder mapping and liaison: identify whether bank is likely to become a selected obliged entity; engage with national regulators; monitor AMLA’s upcoming guidelines / selection criteria

-

Data and systems inventory: map data flows, reporting, IT systems; identify gaps for traceability, cross-border transaction monitoring

-

Resourcing plan: estimate additional staff, budget, and external support needed; hire or train early; plan for centralization or shared services where possible

-

Policy standardisation across jurisdictions: harmonise internal policies, risk classification, onboarding/offboarding, PEP/ sanctions screening to reduce divergence

Medium-Term (2026-2028)

-

Implement technical tools: deploy or upgrade transaction monitoring, AI/ML, analytics for cross-border suspicious patterns; build pipelines for large data sets; enhance model governance

-

Compliance culture and training: firm-wide training; embed AML/CFT in business line planning; set measurable KPIs; align incentives

-

Scenario planning and stress testing: simulate supervisory inspections, enforcement; test readiness for adverse events (e.g. failed STRs, sanctions breaches)

-

Strategic portfolio review: re-evaluate correspondent banking relationships; exposure to high risk jurisdictions; consider withdrawing or offboarding where risk excessive or cost outweighs benefit

-

Collaboration and industry engagement: engage with peers, trade associations, FIUs; monitor AMLA / EU-level regulatory discussions; possibly influence upcoming technical standards

Long-Term (2028 and beyond)

-

Embed continuous improvement: establish a cycle of review, benchmarking against best practices, adapting to evolving ML/TF threats (crypto, AI/tech-enabled crime)

-

Leverage harmonisation for competitive advantage: streamline cross-border services; reduce internal friction; offer clients more consistent experiences across Member States

-

Invest in resilient infrastructure: ensure data privacy / cybersecurity; robust disaster recovery; compliance with technological and regulatory evolution (e.g. blockchain, cross-border payments)

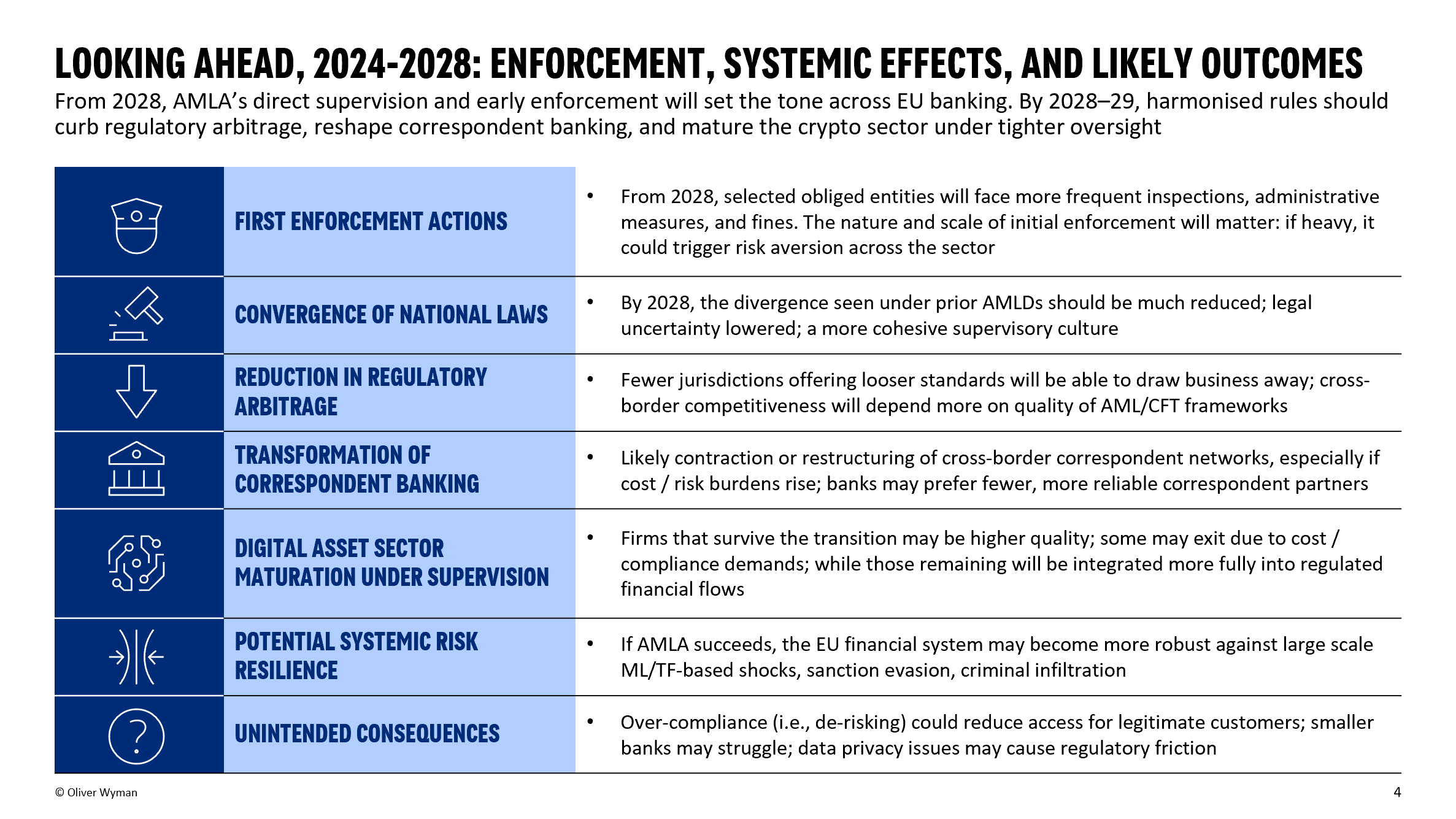

AMLA introduces a new, more centralised, harmonised and enforceable regime for AML/CFT in the EU. For banks, especially those with cross-border profiles, the period 2024-2028 will be one of substantial operational, strategic and financial change. The chief challenges are in upgrading data, systems and processes; managing cost; aligning risk appetite; and preparing for stronger enforcement. But banks that act early—auditing their current state, investing in technology and governance, and shaping their policies to meet the new rulebook—can not only avoid penalties, but gain competitive advantage in a higher transparency, lower arbitrage regime. Leadership should treat AMLA not simply as a compliance burden but as a strategic inflection point: one that may reshape business models, product offerings, and cross-border strategy for years to come

-