Fault Lines in Finance: How Regulatory Divergence Threatens Bank Strategy

-

Fault Lines in Finance: How Regulatory Divergence Threatens Bank Strategy

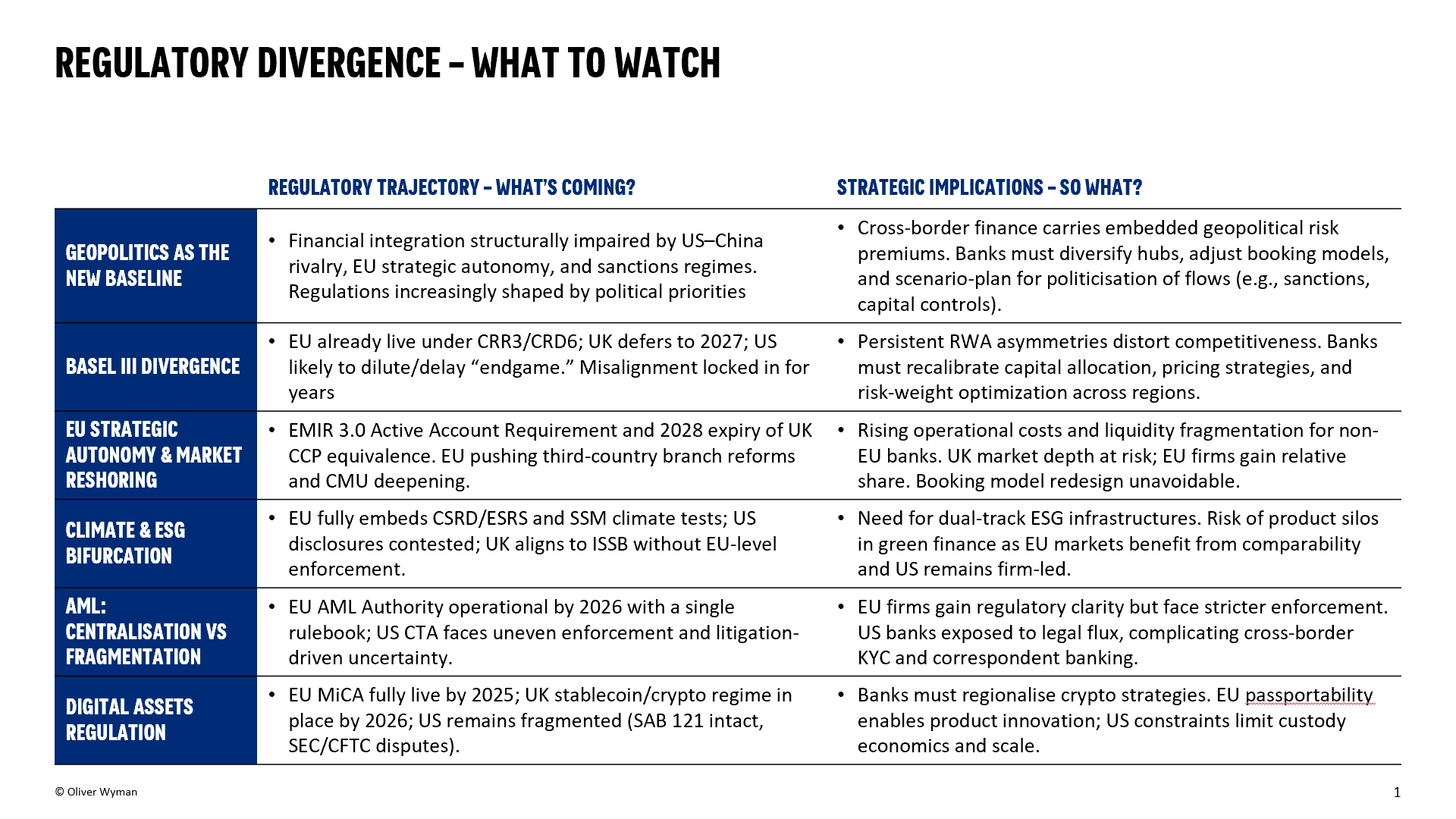

Regulatory fragmentation is accelerating across prudential, conduct, ESG, and digital-asset regimes, creating a new class of strategic risk for banks. What once looked like technical compliance divergence is now reshaping capital allocation, operating models, and competitive positioning. Basel III endgame timelines, for example, are already diverging between the EU, UK, and US, while conduct and markets rules are increasingly used to advance “strategic autonomy,” with direct implications for booking models and market access

At the same time, ESG and digital-asset frameworks are pulling apart: the EU is embedding binding standards in both areas, while the US is retreating from contested climate rules and remains fragmented on crypto policy. The result is dual infrastructures, trapped capital, and rising costs-to-serve, with banks forced to navigate multiple, often conflicting, regulatory expectations

For global and regionally significant banks, the implications go beyond compliance overhead. Fragmentation is driving entity proliferation, technology duplication, and cross-border frictions, while also altering the dynamics of competition—especially as fintech and market structure adapt to new rule sets. Policy coordination continues through the FSB and BIS, but geopolitical pressures now shape the pace and direction of divergence. Strategically, banks must treat regulatory fragmentation as a structural feature of the landscape, not a temporary disruption, and build resilience by aligning regulatory strategy more closely with capital, business model, and market footprint decisions

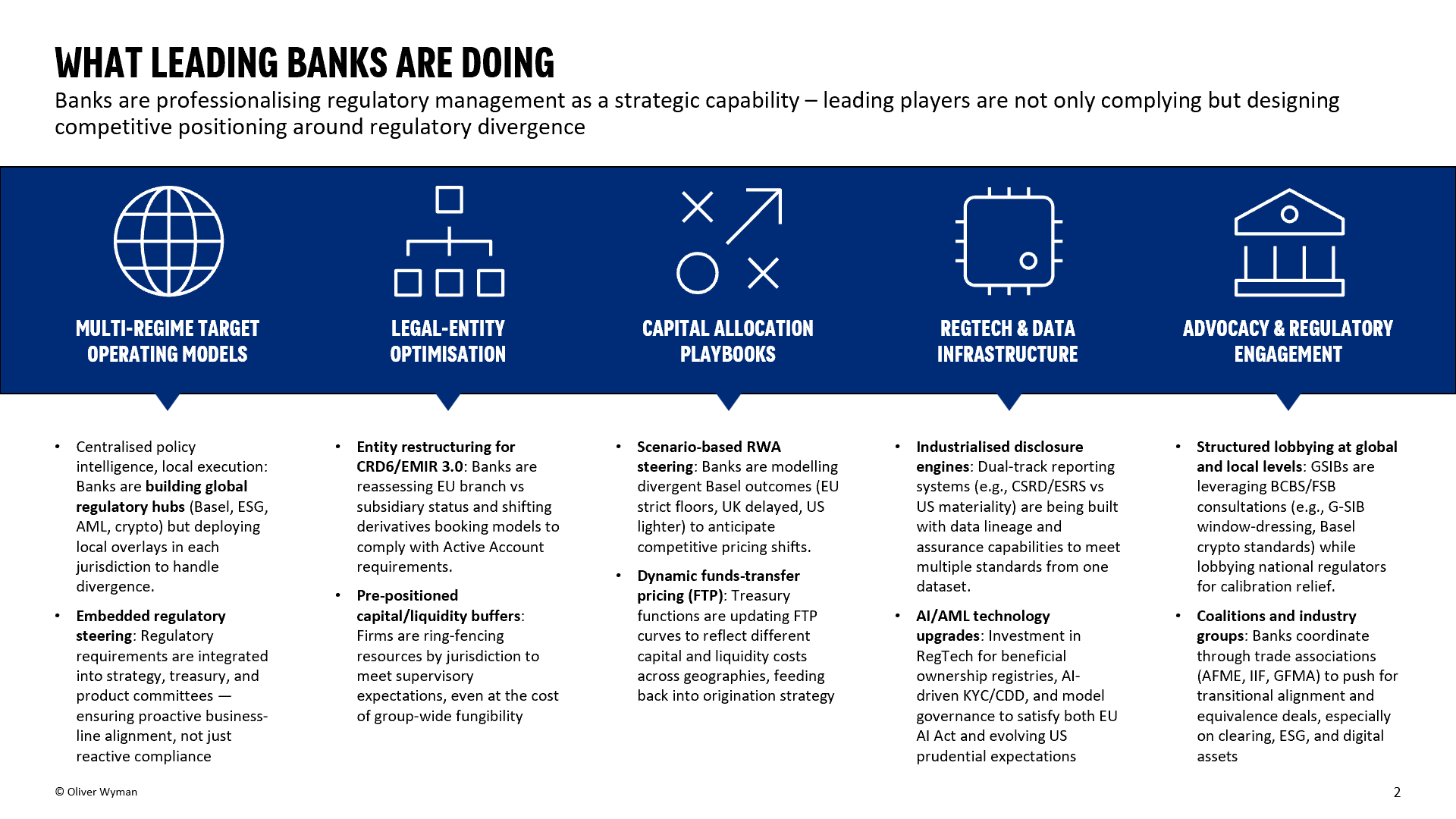

Regulatory fragmentation is no longer a cyclical nuisance tied to the pace of rulemaking; it has become a structural feature of the global financial system. For large international and regionally significant banks, the divergence now cuts across every strategic dimension—capital efficiency, market access, innovation, and talent deployment. What once could be managed within compliance budgets now requires board-level oversight, enterprise-wide operating model redesign, and forward-looking capital allocation strategies

The strategic risk lies not only in higher costs or operational duplication, but in the gradual erosion of cross-border scale advantages that underpin the business models of global systemically important banks. If left unmanaged, fragmentation could tilt competitiveness toward purely domestic or regionally anchored institutions and further re-nationalize finance, weakening global market integration at a time when geopolitical and economic fragmentation are already intensifying

Banks that succeed will treat regulatory divergence as a competitive variable to be managed proactively: embedding jurisdictional optionality into booking and entity structures, industrializing disclosure and reporting systems, and aligning capital allocation models to regulatory outcomes. At the same time, they must remain credible advocates for international convergence, working with standard setters and supervisors to preserve a minimum baseline of interoperability

Over the next five years, those who view fragmentation through a strategic lens rather than a compliance lens will be better positioned not just to survive, but to convert regulatory asymmetries into a source of resilience, differentiation, and influence in shaping the future financial architecture