Geopolitical Risk – getting real

-

Since we wrote about geopolitical risk last year, we have seen industry practice evolve and we felt an update is warranted. Over the past six months, geopolitical risk has evolved from a peripheral factor to a structural dimension of enterprise risk management. Across client engagements in Europe, the US, and APAC, we observe a clear shift: leading banks are beginning to treat geopolitical uncertainty not just as a backdrop to macroeconomic scenarios or part of the Country Risk Teams, but as a direct risk driver.

The change is being accelerated by supervisory focus—particularly in Europe. Institutions are expected to treat geopolitical developments as a material influence on their risk profile, both from a financial and non-financial perspective. The ECB has elevated this expectation as part of its core supervisory agenda for 2025–2027, which is already shaping risk steering discussions at board level.

At a practical level, we see three main developments gaining traction:

-

Geopolitical risk is becoming multi-dimensional. It's no longer confined to sovereign credit or country risk. The emerging practice is clear: geopolitical risk must be treated not as a siloed topic, but as a cross-cutting input into enterprise steering—from risk appetite to capital strategy, from third-party governance to digital infrastructure planning.

-

Operational exposure is moving to the forefront. With increasing tension in global trade, the resilience of core operations—especially IT and critical vendor networks—is under renewed scrutiny. Cybersecurity, cloud sovereignty, and compliance with regional digital sovereignty laws (e.g. DORA) are now viewed through a geopolitical lens.

-

Risk management approaches are becoming more forward-thinking. Rather than waiting for events to materialize, banks are building structured response capabilities based on scenario analysis, cross-functional simulations, and targeted early-warning frameworks.

In conversations with risk and strategy executives across global banks, a common theme is emerging: the need to move from fragmented, reactive risk tracking to a coherent and mature, cross-functional framework that embeds geopolitical thinking into core risk processes.

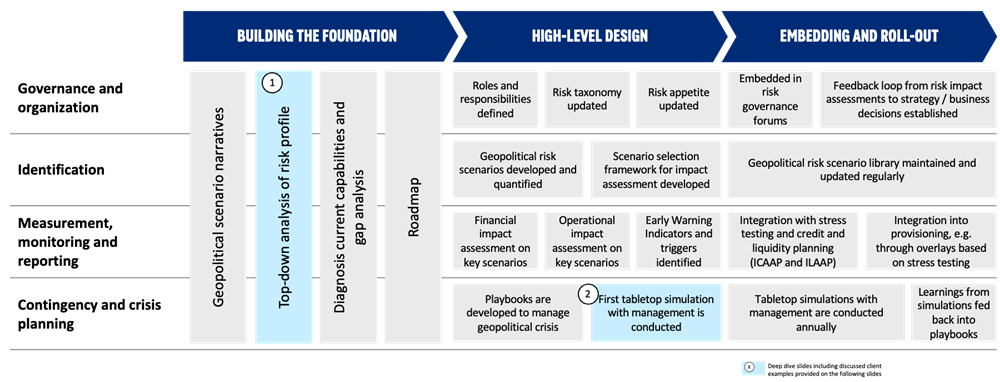

Figure 1: Oliver Wyman Geopolitical Risk Management Framework

While practices vary widely, two elements are consistently present among institutions leading the field, which we describe below: top-down portfolio scans for geopolitical sensitivity, and crisis simulation.

Top-Down Portfolio Scans for Geopolitical Sensitivity

Before banks can simulate or plan for geopolitical disruption, they need clarity on where they are most exposed. That requires a structured, top-down portfolio view—not just of credit and market exposures, but of operational and third-party dependencies that could be vulnerable to geopolitical shifts. Risk measurement and quantification have also made progress, where top-down portfolio analysis is typically the starting point to prioritize efforts across the existing risk types.

When starting with the analysis, the selection of portfolio scope is the first determinant. Peers are typically starting with the lending, securities and deposits portfolio on group level. When defining the scenarios for the portfolio assessment institutions employ a small set of intuitive, high-level geopolitical risk scenarios such as increasing trade and investment restrictions.

The portfolio segmentation is analyzed for vulnerability to 1st and selected 2nd order effects (especially energy / commodity prices and supply chain disruptions). For the top-down portfolio assessment, most institutions conduct a qualitative impact assessment, clearly identifying relevant risk drivers for the respective primary risk types.

Multi-format crisis simulation

Once sensitive exposure areas are identified, banks can run simulations to assess how geopolitical events would affect their operations, risk profile, and strategic posture. This is no longer a theoretical exercise. Take the energy-related grid shutdown in Spain, Portugal and France earlier this year. While the root causes were not directly geopolitical, the systemic impact mirrored what could happen in a true geopolitical escalation—forcing multiple banks to activate contingency procedures, reroute processing, and adjust liquidity buffers in real-time.

Crisis simulations with geopolitical triggers serve three key purposes:

-

They test multi-dimensional resilience—from financial metrics (capital, liquidity) to operational continuity and reputational response;

-

They sharpen cross-functional preparedness: involving risk, IT, legal, communications, and business continuity teams in a coordinated stress response; and

-

They surface second- and third-order effects—such as delays in reporting due to system outages, failure of key vendors in conflict regions, or jurisdictional clashes over regulatory compliance

Depending on the institution’s maturity and exposure, a range of simulation formats is currently being used, from tabletop exercises for initial risk awareness and coordination, through war-gaming scenarios that simulate adversarial moves across regulatory or geopolitical dimensions, all the way to full-scale crisis simulations, including real-time decision-making, interdepartmental coordination, and post-mortem analysis.

We are experiencing a new wave of tariff announcements and conflict in the Middle East. While short-term uncertainty may dominate headlines, leading institutions treat it as a catalyst for deliberate, long-term positioning. Key structural shifts—around global alignment, digital sovereignty, and economic fragmentation—require active engagement and banks are using this phase to start building lasting resilience through governance, scenario design, and strategic alignment.

-